The 1 Minute Forex Scalping Strategy With Trendlines And Pin Bars is in my opinion, one of the best Forex Scalping systems you can ever use.

I tend to use this combined with multiple timeframe trading to trade on trading setups on larger timeframes and I can tell you, it is an amazing forex trading system to use simply because your stop loss are tight and as soon as you buy or sell, the price moves away quickly which means your trade does not waste time to become profitable (That’s when your analysis is right, by the way so if you lose, you lose small)

Trading Parameters and Requirements

Timeframe: 1 minute, but you can also use 5 minute timeframe as well.

Currency Pairs: currency pairs with low spreads will work just fine, like, EURUSD, GBPUSD, USDCHF, AUDUSD, USDJPY

Indicators: None required

Trading Session: Only London and New York

Trendlines: you should know how to draw trendlines

Pin Bars: you should know how to identify the pin bar or otherwise use this pin bar indicator mt4

Buying Rules

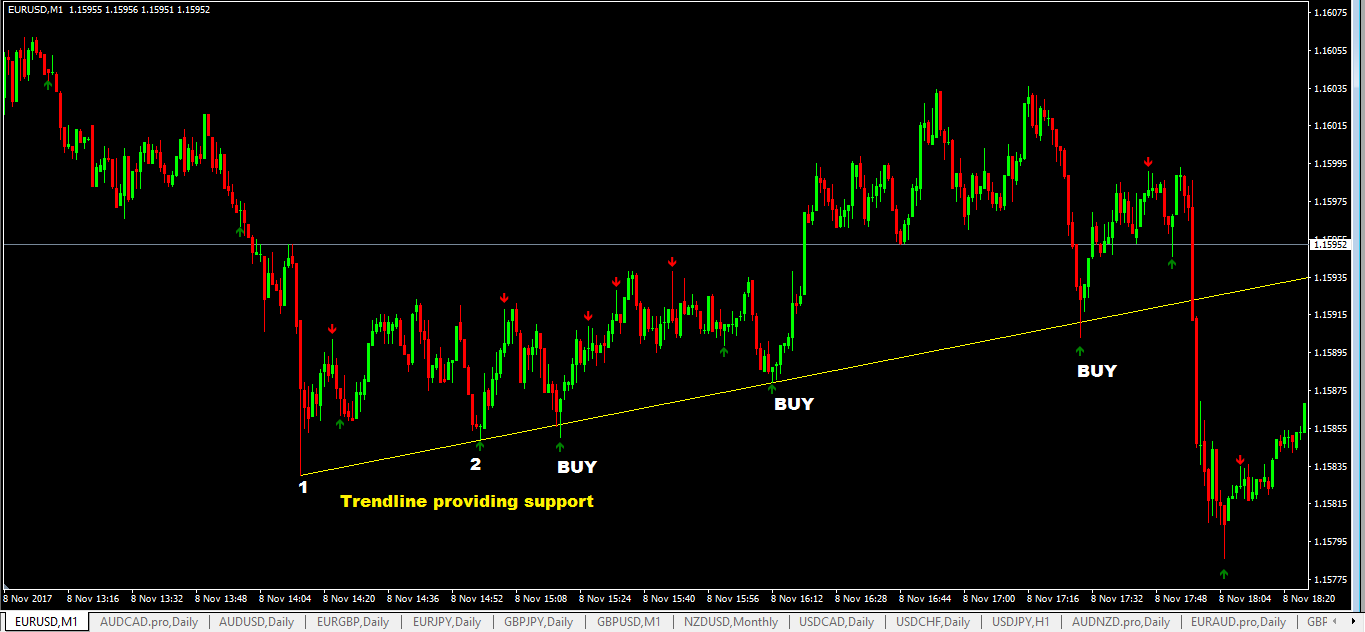

- identify swing lows and use two points (numbered 1 & 2 on the chart below) to draw your upward trendline.

- wait for the price to come down and hit the trendline and when it does, watch that candlestick to see if it is a bullish pin bar forms.

- at the close of the bullish pin bar, you can immediately buy at market order or place a pending buy stop order 1 pip above the high of the bullish pin bar.

- Place your stop loss at least 5 pips below the low of the bullish pin bar

- For take profit, aim for risk:reward of 1:3 or if there’s a previous swing high that has a risk:reward of 1:3 or more if price reaches it then use that as your take profit target level.

Selling Rules

- identify swing high and use two points (numbered 1 & 2 on chart below) to draw your downward trendline.

- wait for price to come down and hit the trendline and when it does, watch that candlestick to see if it is a bearish pin bar forms.

- at the close of the bearish pin bar, you can immediately sell at market order or place a pending sell stop order 1 pip below the low of the bearish pin bar.

- Place your stop loss at least 5 pips above the high of the bearish pin bar

- For take profit, aim for risk:reward of 1:3 or if there’s a previous swing low that has a risk:reward of 1:3 or more if price reaches it then use that as your take profit target level.

Disadvantages of The 1 Minute Forex Scalping Strategy

- false spikes may knock out your stop loss and then you’ll see price moving in the direction of your “knocked out” trade.

- tends to perform poorly in flat or ranging markets so you need to make sure the market is trending good before you use this system.

- if spreads increase, you may need to increase this distance of your stop loss and not to place it too close to your entry price level to avoid getting stopped out prematurely in your trade.

Advantages of the 1 Minute Forex Scalping System

- a great forex scalping system to use in a trending market

- tight stop loss with great risk:reward

- profits happen quickly

Other Forex Trading Scalping Systems And Trading Resources On This Site You May Be Interested In

- Bollinger bands indicator 5 minute forex scalping strategy

- 20 pips gbpjpy forex scalping strategy

- simple gbpusd eurusd forex scalping strategy

- forex price action trading course

- forex swing trading course

- forex multiple timeframe trading course