The 50 pips a day forex trading strategy is a strategy which you can use to trade the GBPUSD and the EURUSD.

The whole idea of the 50 pips forex trading strategy is to capture just 50% or 33% of the daily range move of the currency pair. And usually, the best times to do that would be just before the London Forex Session.

What Timeframes Are Required?

It is suggested that you use 1 hr timeframe, however you can try with others to see how it works out for you.

Any Forex Indicators Required?

No. You don’t need any indicators.

Can You Use This On Any Currency Apart From GBPUSD & EURUSD?

You can but make sure that:

- The daily range of the currency pair is at least 100 pips or more

- Make sure the currency pair has a “USD” as a base or counter currency.

The Trading Setup & The Rules

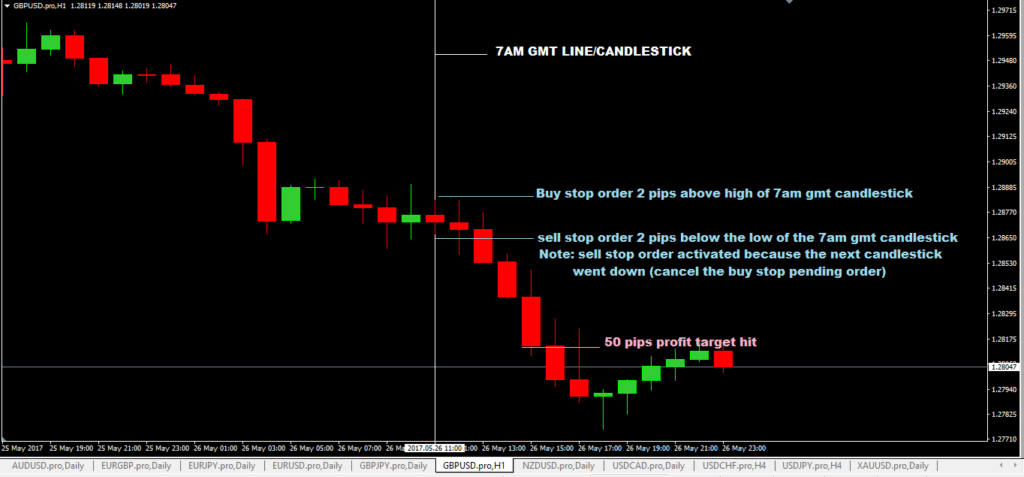

- You need to use the 7am GMT 1 hour candlestick on your chart.

- how do you know the time you see on your chart matches that 7am GMT? Simple: ask your forex broker or do a simple google search to find out what 7am GMT is in your timezone(country).

Here are the trading rules:

- As soon as the 7am 1HR GMT candlestick closes, place to opposite pending orders: a buy stop order 2 pips above the high and sell stop order 2 pips below the low.

- As soon as one pending order is activated, you must immediately cancel the other pending order.

- For stop loss, place 5-10 pips below the low of the 7AM GMT candle for a buy order and 5-10 pips above the high of the 7am GMT candlestick for a a sell order.

- The take profit target is 50 pips.

Once your trade is activated, do not touch that trade. Let the market do its thing… Which means let the trade play out. If your profit target is hit, great, if not still great! Repeat the process the next day!

Now the next question is this: what if your profit target you set is not hit and the trade has a floating profit or floating loss and the day is over and next daily candlestick has formed?

Well in that case you can do the following options:

- Close the trade regardless of the floating profit or loss

- Or you can move your stop loss to break even or a trade with a floating profit making your trade risk free and place the next trade on the new day’s 7AM gmt candlestick.

Advantages of 50 Pips A Day Forex Trading Strategy

- It is a set and forget kind of forex trading strategy after one pending order is activated and you cancel the other pending order.

- Reduces over trading… Why? Because your maxing number of trades per day would be only 2 trades if you only follow two currencies. If you trade only one currency, you’d be only doing 1 trade per day and in a week, you will only do 5 trades.

Disadvantages Of the 50 Pips A Day Forex Trading Strategy

- If you are a trader that like to be looking for a lot of trading setups each day, this forex trading strategy is not for you.

- You only limit your profits to 50 pips a day. What if price moved 200 pips in that day?

- If you are not watching and cancel the other pending order, you can have a situation where both pending orders can be activated and have bot stop losses being hit.

Other forex trading strategies you may also be interested in are: