The bull trap pattern forex trading strategy is based on the pattern called the bull trap.

If you don’t know what a bull trap pattern or setup look like, I will show you here.

A bull trap is the exact opposite of a bear trap and this bear trap forex trading strategy here explains what a bear trap chart pattern looks like as well.

What Is A Bull Trap In Forex?

A bull trap is a kind of pattern or you may also call a trading setup that traps bulls (buyers) into thinking that price is going to go up.

But this upward rally is shor- lived and at the end of the certain timeframe or period, price comes back down and closes close to where it opened at or below where it opened it (generally speaking as there are variations of bull traps which I intend to write up some time in the future).

So from this, you can already figure out that a bull trap is a bearish pattern or trade setup.

In my opinion, the best place to watch for bull trap setups to form in on resistance levels.

What you will see is price will break the resistance level and head up/pretending to go up but soon after, it will start coming back down.

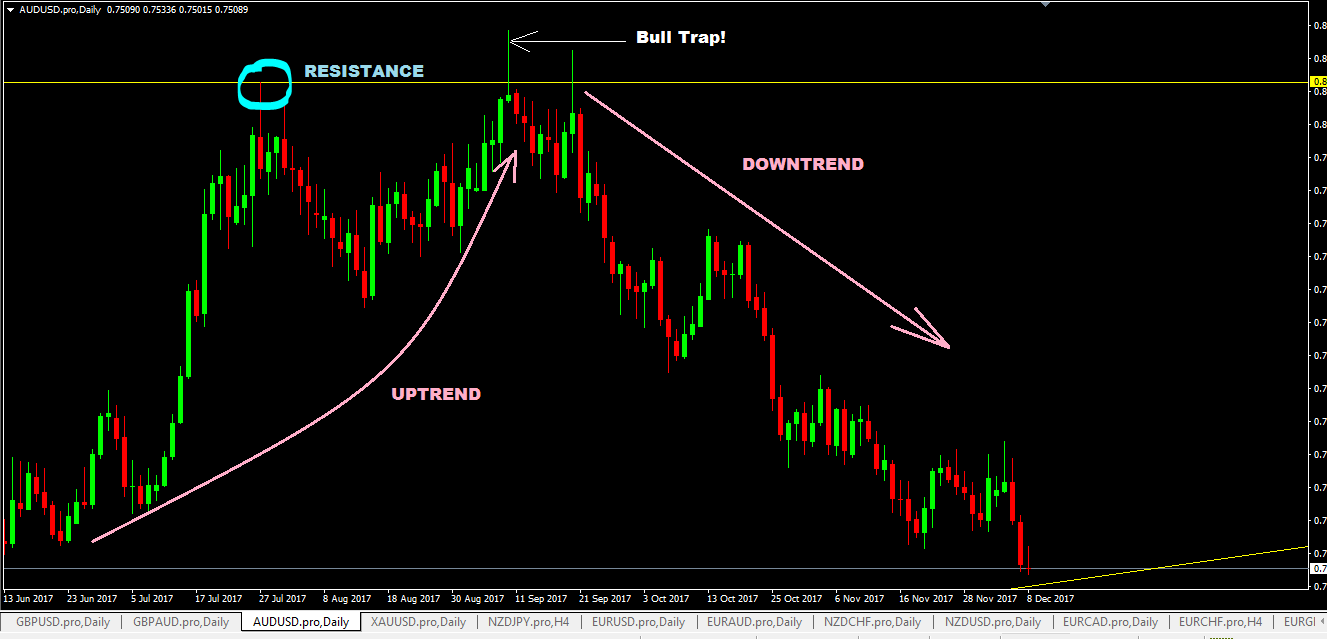

Here are few chart examples of bull traps:

- On this chart below, you can see price made a resistance and moved down and then came up and broke past it as if to continue going up but it was short-lived.

- price moved back downs and closed below the resistance level

- A pin bar was formed as a result and you can see what happened after that: price moved down.

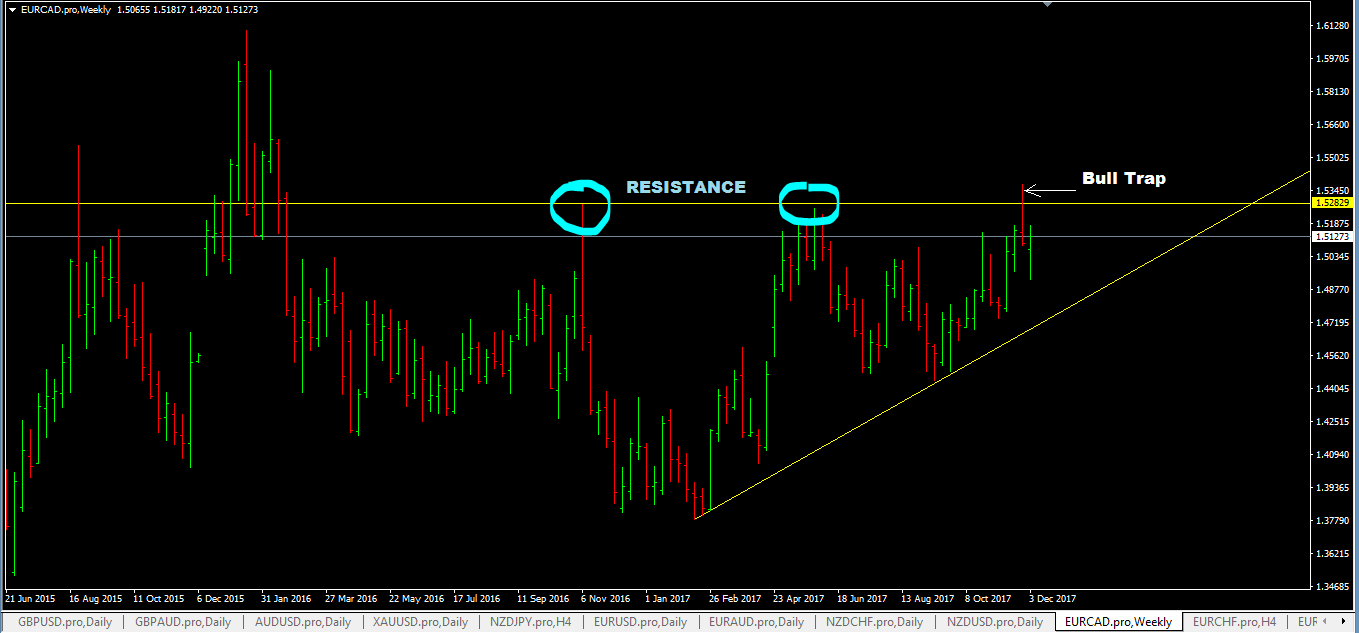

Here’s another one:

- notice the resistance level/zone price hit on two previous occasions and moved down.

- on the third occasion, it hit the resistance level and went up past it but then price went down and closed way below the resistance level.

- and after that price did travel down a fair bit as you can see on the chart below.

Now that you’ve seen what a bull trap setup can look like, it is fairly easy to come up with the trading rules on how to trade bull trap trade setups.

Trading Rules

Bull trap setups are bearish setups so this is a sell rule only:

- identify major resistance levels and watch the price action when price goes to test these resistance levels again.

- if price breaks the resistance levels but that candlestick closes close to or below the resistance level, then place a pending sell stop order 1-2 pips below the low of that candlestick.

- Place our stop loss 2 pips above the high of that bull trap candlestick.

- For take profit, aim for 1:3 risk to reward ratio or look for previous swing lows and use them as your take profit target levels.

What Happens You Are Caught In A Bull Trap Situation?

Suppose you strongly believe that price is going to break the resistance level and you placed a buy breakout trade but later it turned out to be a bull trap, what should you do?

Well…the price action is showing you clearly that it is a bull trap.

So if I were you, I’f I’m not already stopped out, I’ll take my loss and following the trading rules given above so that I can be in a sell trade.