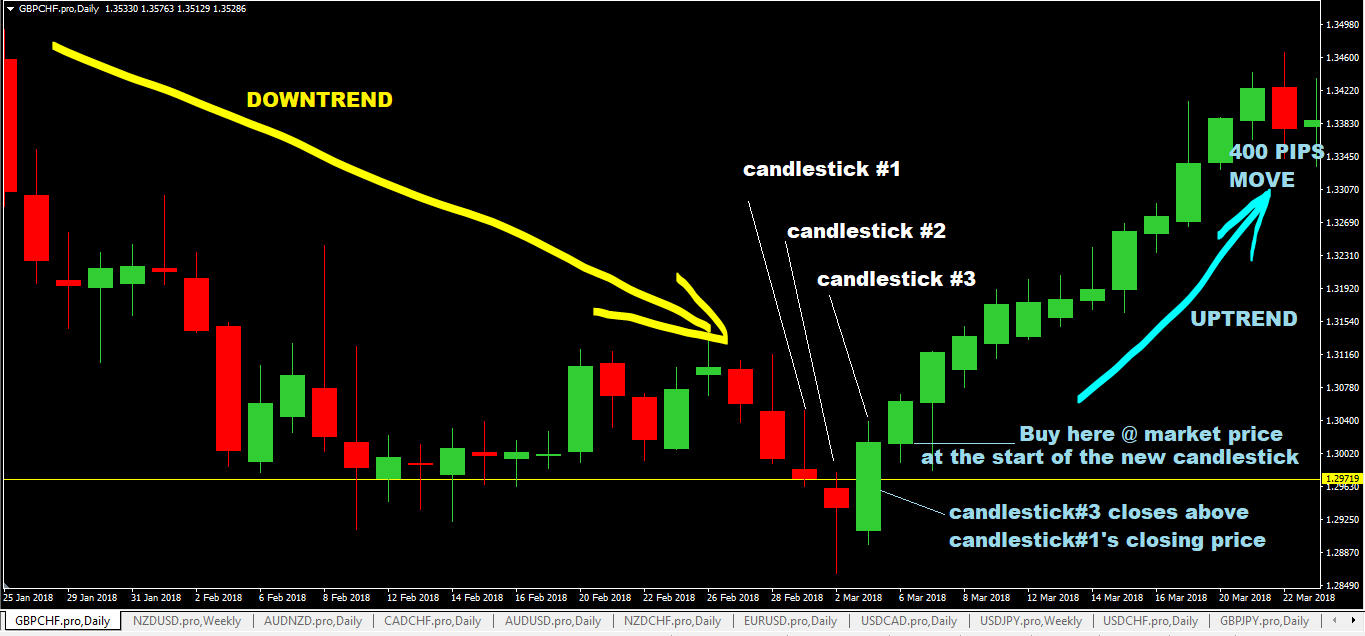

The Daily Chart 3 Candlestick Forex Trading Strategy, is a trading system you can use to trade trend reversals.

If a market has been trending down for a time, identifying the 3 daily candlesticks that form this pattern, you can enter into a buy trade potentially at the bottom where the price starts turning.

Similarly, but on the opposite, you can do the same for a sell trade setup situations.

With this trading system, you are not aiming for 10-20 pips profit but profits in excess of 100 pips per trade.

Trading Parameters And Requirements

- Currency Pair: Any

- Timeframes: Daily (But if you miss daily trading signals, switch to lower timeframes and look for the a similar trade setup to get into a trade)

- Indicators: none required buy you may need this zigzag indicator mt4 for trailing stop your trades.

Buying Rules

- The market has been in a downtrend at least for the last 3 days. You want to see at last a minimum of 3 consecutive days of bearish (RED) candlesticks form.

- Candlestick # 3 closes above the closing price of Candlestick #1.

- Buy at immediate market price as soon as the next candlestick starts forming.

- stop loss is 50 pips

- Take Profit Target is to aim for 100-400 pips profit targets.

- Trade management: use trailing stop to lock in profits as price heads towards your take profit target. The best way to do it is to move stop loss (trail stop) behind higher swing lows in the price structure until your profit target gets hit or you get stopped out with a profit.

Selling Rules

- The market has been in an uptrend for at least 3 days. You must have at least a minimum of 3 consecutive days of bullish (green candlesticks)

- Candlestick #3 closes below candlestick#1 closing price.

- As soon as the next candlestick starts, sell at market price.

- place stop loss at 50 pips

- Take Profit Target is 100 to 400 pips.

- Trade Management using trailing stop: as price moves in favour, it is better to trail stop your trade and lock in profits. Use the lower swing highs of price structure and place your stop loss behind each subsequent lower one that forms until you get stopped out or your take profit target is hit.

Advantages of The Daily Chart 3 Candlestick

- You want to make 100-300 and above in profits per trade? Then this system is one of them to give you that.

- Risk/Reward is really good.

- A very simple pattern to understand and implement.

- To give more validity to your buy and sell signals, use price action confluence points and levels, etc.

For example, use this pattern and confirm it with support, resistance, and Fibonacci levels as well as trendline bounces as well other chart patterns that may form. You have to take a step back and look at all the possible confluence factors that may be present or coming into play at the level where this 3 candlestick pattern is forming.

Disadvantages of The Daily Chart 3 Candlestick

- No trading system is the holy grail. Expect false signals which mean trading losses will occur.

- The #3 candlestick can sometimes be extremely long in some situations. I would suggest, you don’t trade such setups.

- Will you have the patience and nerve to sit and hold on tight for many days when your trade is in progress and even during those times, minor market reversal can happen and eat into your profits…will you bail out too soon only to realize if you held on, you could have made 900 pips profit in 20 days?