What is the spread when trading forex?

In this post, you will learn:

- What is the spread

- How the spread is calculated

- What is the purpose of spreads

- Why the size of the spread matters in trading

- How to minimize spread in trading

What Is Spread?

Spread is simply the difference between the ASK and BID prices given in Pips, like 2 pip spread, 3 pips spread etc.

You see, the price of any currency pair often comes in two prices:

- The first price is the bid price

- The second price is the ask price.

Now, the bid price is simply how much being offered for the currency pair. The ask price is simply how much the sellers as asking.

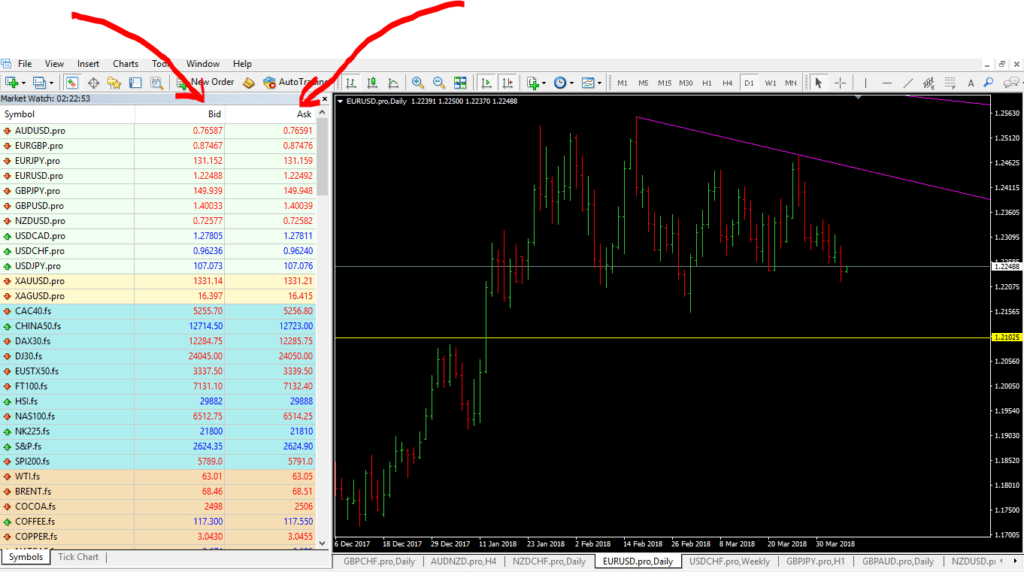

In the MT4 trading platform, under “market watch” you will see a list of all the currencies pairs symbols traded as well as their bid and ask price. (See chart below):

How To Calculate Forex Spread

Now, to calculate spread, you simply subtract the ask price from the bid price.

Looking at AUDUSD chart above, you can see that Ask price is 0.7659 and Bid price is 0.7658.

The difference is=0.0001 or 1 pip spread.

What Is The Purpose Of A Spread?

To trade forex, you have to trade through a forex broker. Call them middlemen if you want… And guess what? Middlemen need their “cut.”

So the spread is their cut or their fees for you doing your trade. Different brokers therefore compete to offer better spreads. Check out the difference in spreads on a few assets at Pepperstone versus ForTrade.

But hang on, there’s more: The spread is built into any currency trade you place which essentially means the any trade your place is a $0 commission trade. That means, for a trade to become profitable, the trade has to overcome the spread.

Now, going back to the calculation of AUDUSD spread given above, the spread is 1 pip. If you traded 1 standard lot or contract of AUDUSD, how much in $ does the broker receive? Answer: $10. (Value of 1 pip)

Look at this the other way: the spread is also your transaction cost because you have to pay the broker.

Why Does Spread Matter In Your Trading?

This is why spread matters in your trading: the more trades you do in day or in a month, your transaction costs increases and the more money the forex broker makes from the spread it charges.

For example, if you do 1000 standard contract trades a month and if the spread is 1 pip per contract ($10/per contract), then the broker has made $10,000 at the end of the month regardless of whether you’ve made a profit or loss during that month.

What Affects Forex Spreads

How To Manage And Minimize Spread When Trading

These are the factors that affect the size of spread in forex trading:

- Liquidity. Most actively traded currency pairs in the foreign exchange market have high liquidity therefore, the result is low spreads during the most active forex sessions like the London and New York Trading Sessions. Rare currency pairs have have huge spreads.

- Size of deals/trades. Large volume traders can negotiate with forex brokers on getting lower spreads.

- Volatile Market. Spreads tend to widen during important forex fundamental news announcement like interest rate announcements, jobs and employment data announcements etc.

So the two main ways you can minimize your spread is:

- Trade only during active trading hours where there are many buyers and sellers in the market

- Avoid buying thinly traded currencies/rare currencies.