If you want to learn about swing trading, then this free swing trading course will give you the foundation you need to get started.

Forex presents lots of great opportunities of swing trading.

The key to successful swing trading is being patient to wait for trading setups to form, and also have the patience to wait for the trade to play out.

In addition, you need to have reliable swing trading strategies and prudent risk management practices.

I hope that at the end of this swing trading course, you will have a better understand of how to go about doing swing trading in forex.

Swing Trading Definition

Swing Trading as defined by Wikipedia is this:

Swing trading is a speculative activity in financial markets where a tradable asset is held for between one and several days in an effort to profit from price changes or ‘swings’.A swing trading position is typically held longer than a day trading position, but shorter than buy and hold investment strategies that can be held for months or years. Profits can be sought by either buying an asset or short selling. Momentum signals (e.g., 52-week high/low) have been shown to be used by financial analysts in their buy and sell recommendations that can be applied in swing trading.

If you have been a swing trader for some time, you may find new swing trading techniques and ideas or build upon what you already know and go from there. Or you can find a new swing trading strategy that you can use also.

Swing Trading, what is it? What Is The difference between swing trading strategies and day trading strategies or scalping or trend trading strategies?

In here your questions will be answered.

But first…

Wikipedia describes swing trading as a speculative trading activity in any financial market whereby instruments such as currencies are

bought or sold at or near the end of up or down price swings.

But that being said…if you are swing trading dummy:

- would you have a clue of what price swings are?

- would you have a clue of what is an upswing or downswing?

- do you know what is a price rally or pullback? Do you know what they mean?

I bet you don’t (or maybe you’d know little).

So lets get into more detail, shall we? This is your introduction to swing trading.

Price Swings Explained

What are price swings?

Definition of price swings: when the market is in an uptrend or a downtrend, price moves in waves called swings or price swings.

There are two types of price swings: an upswing and a downswing.

Now, in an uptrend market, there will be both upswings and downswings.

Similarly, in a downtrend market, there will be both and upswing and a downswing.

Let’s look at these closely…

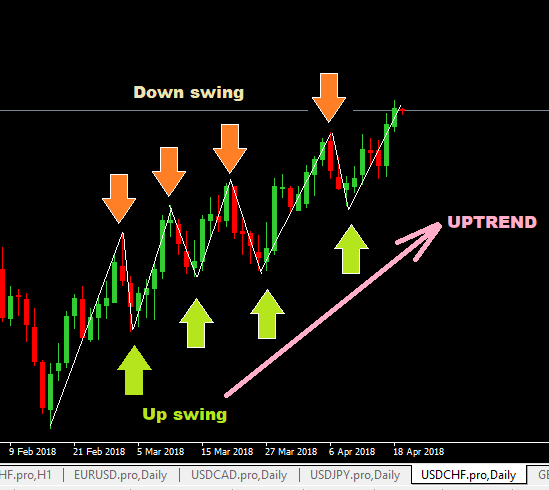

Up Swings And Down swings In An Uptrend Market

Just notice that this USDCHF daily forex chart below, the market is in an uptrend and price is rising but during its rising, its also falling back down.

This falling back down from the peak formed to the bottom where it starts to rise again is called the “down swing”. The down swing is not just the peak where price reverses. It is the distance moved actually, from the peak made to the bottom when price starts to rise again.

Similarly, an upswing in an uptrend is when price makes a bottom and heads up and makes a peak and starts reversing back down again.

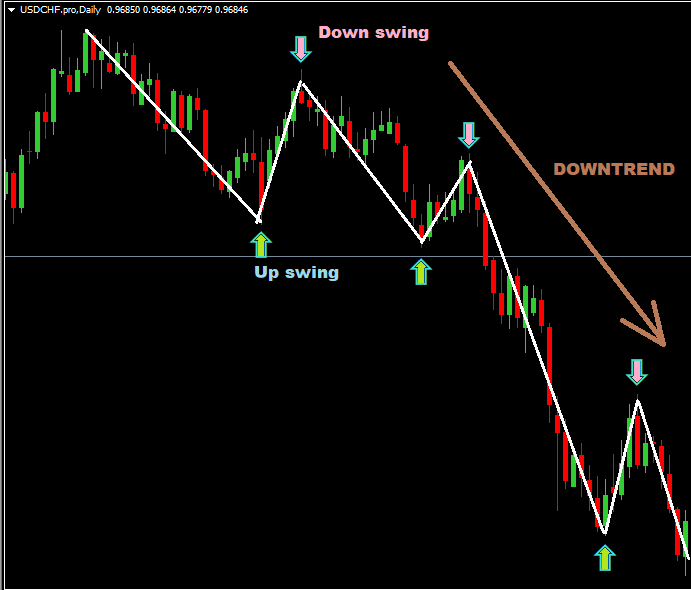

Upswings and Downswings In A Downtrend Market

This is what a downtrend looks like with price upswings and down swings:

Summary of Price Swings

When price moves either up or down it it forms peaks and troughs(bottoms) therefore:

- peak to trough=downswing

- trough to peak=upswing

Trends

The next thing that you need to understand in swing trading is the concept of price trends and these include but are not limited to the following:

- what is a trend

- how do trends form or how do you know when a trend is just starting?

- when does a trend end or how do you know a trend has just ended ?

- how to identify a trending market?

Now, lets get into more detail…

What Is A Trend?

This is most simplest definition of what a trend is: A trend is the movement of price up or down or sideways over time.

- When price is consistently moving up, forming Higher Highs and Higher Lows, this is called an uptrend.

- When the price is consistently moving down, forming Lower Highs and Lower Lows, this is called a downtrend.

- When Price Price is moving sideways, it is called sideways trend. In such a sideways trending situation, price is neither going up or down.

These bullet points statements above are the keys to identifying a trending market or a sideways trending market.

Structure of A Trend: How It Ends Or Starts

To understand trends, especially how trends start and end, you have to know briefly about a theory called the Dow Theory.

The Dow Theory is basically a technical analysis theory based on price action that tries give traders a way to analyse price charts to determine:

- if a trend is starting/ending

- or if a trend still exists

Note this: the beginning of another trend is the end of another trend.

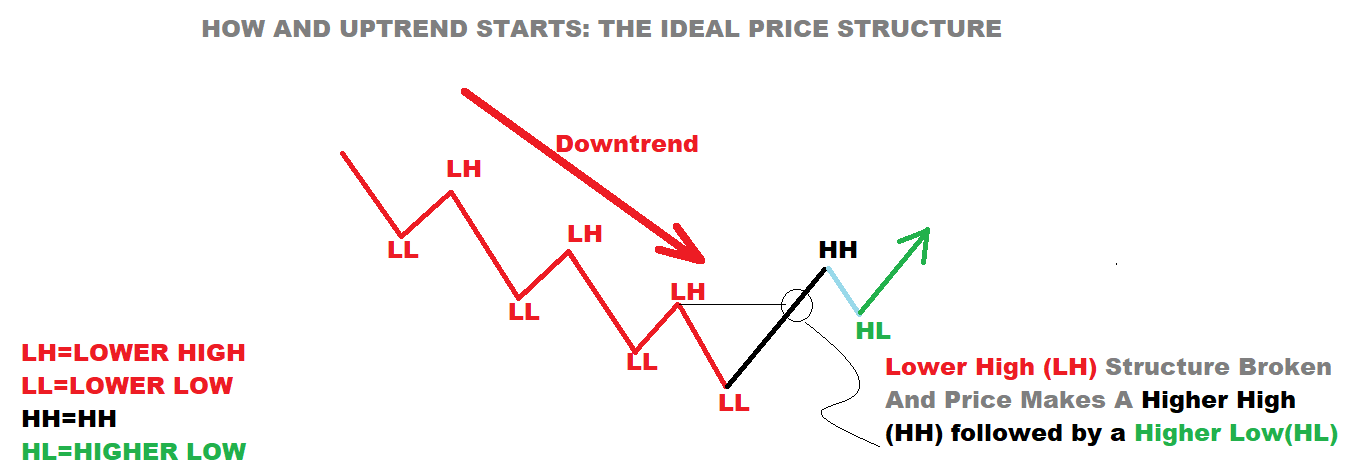

How An Uptrend Starts

This chart below shows an ideal price structure of how a downtrend ends and an uptrend starts…

- So a downtrend price structure consists of price continue to form lower highs and lower lows.

- so when this price structure is disrupted by the formation of a Higher High, this is the first signal that the downtrend may be coming to and end. It is not complete yet. This first signal has to be followed through by a formation of a Higher Low and when price moves up past the first higher high, then that confirms the start of an uptrend.

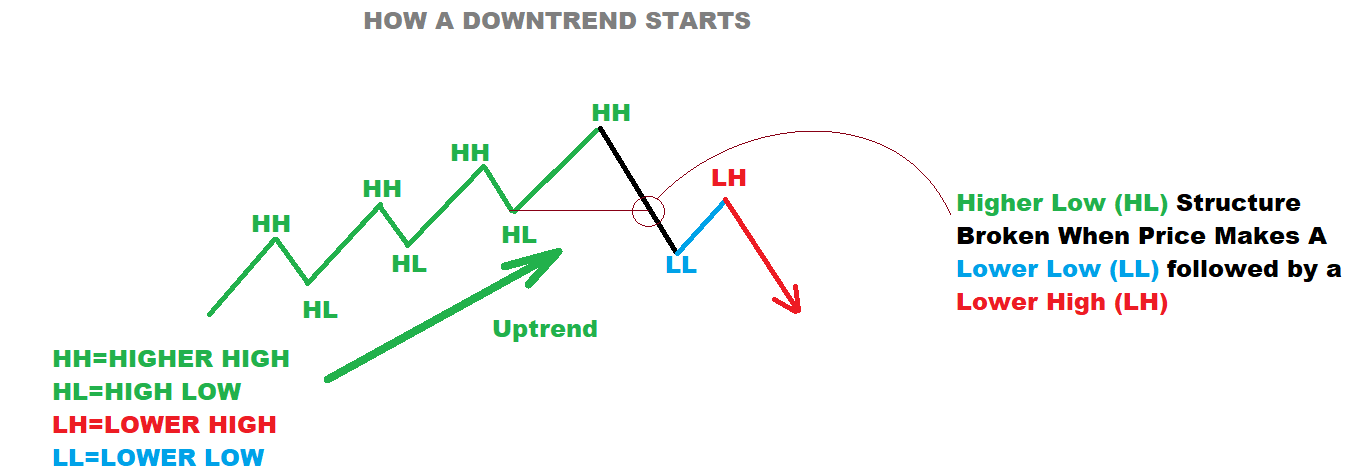

How A Downtrend Starts

A downtrend price structure is completely opposite the uptrend price structure seen above:

- in a downtrend price will continue to make lower highs and lower lows.

- so a downtrend starts when the uptrend price structure of of higher highs and higher lows is broken when price breaks the previous low (higher low) and makes a lower low followed by a lower high that fails to go past the previous higher high.

The Best Location To Buy Or Sell In A Swing Trade

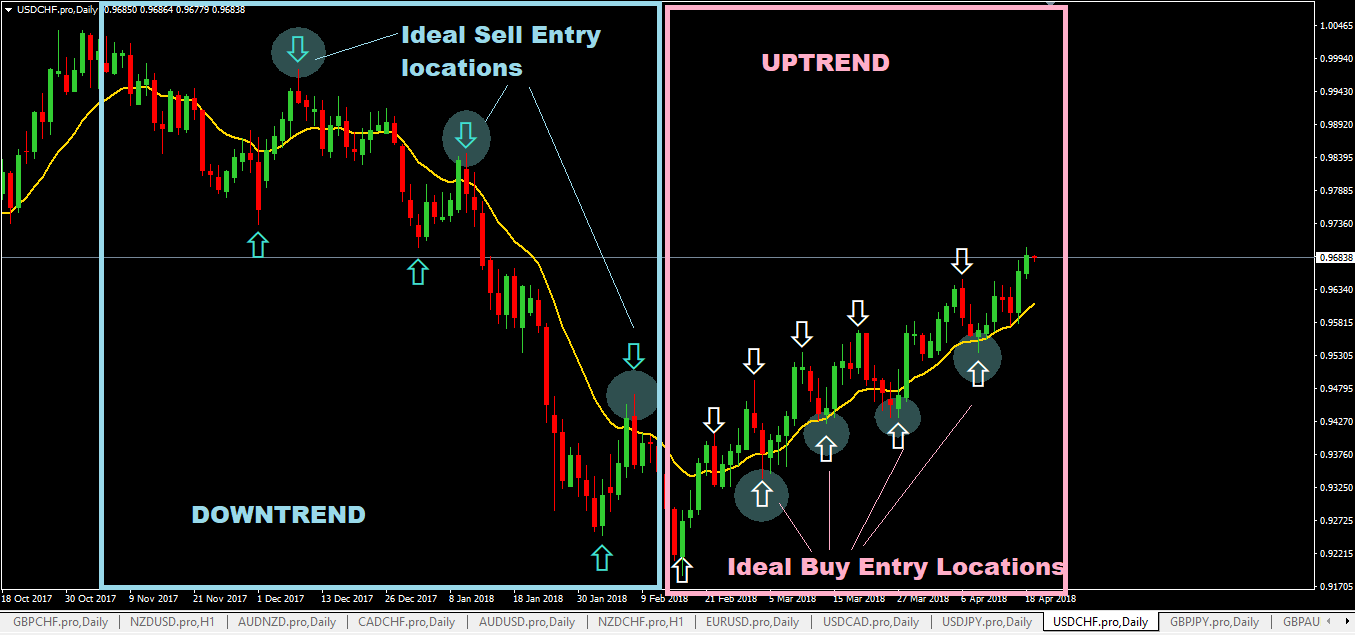

The two ideal trade entry points for swing trading are these (note the word “ideal) used here:

- the ideal entry point or location for a sell trade would be right where the peak forms in an upwswing in a downtrend.

- the ideal location to buy will be right where price makes a down swing bottom in an uptrend.

See chart below to see what I meant:

The Advantages Of Trading At These Ideal Entry Points

- you can have tight stop losses with less chance of getting stopped out prematurely

- price tends to move away from your entry point quite quickly which means your trade is in profit quite quickly as well which can allow you to move your stop loss and lock in some profits much quicker as well.

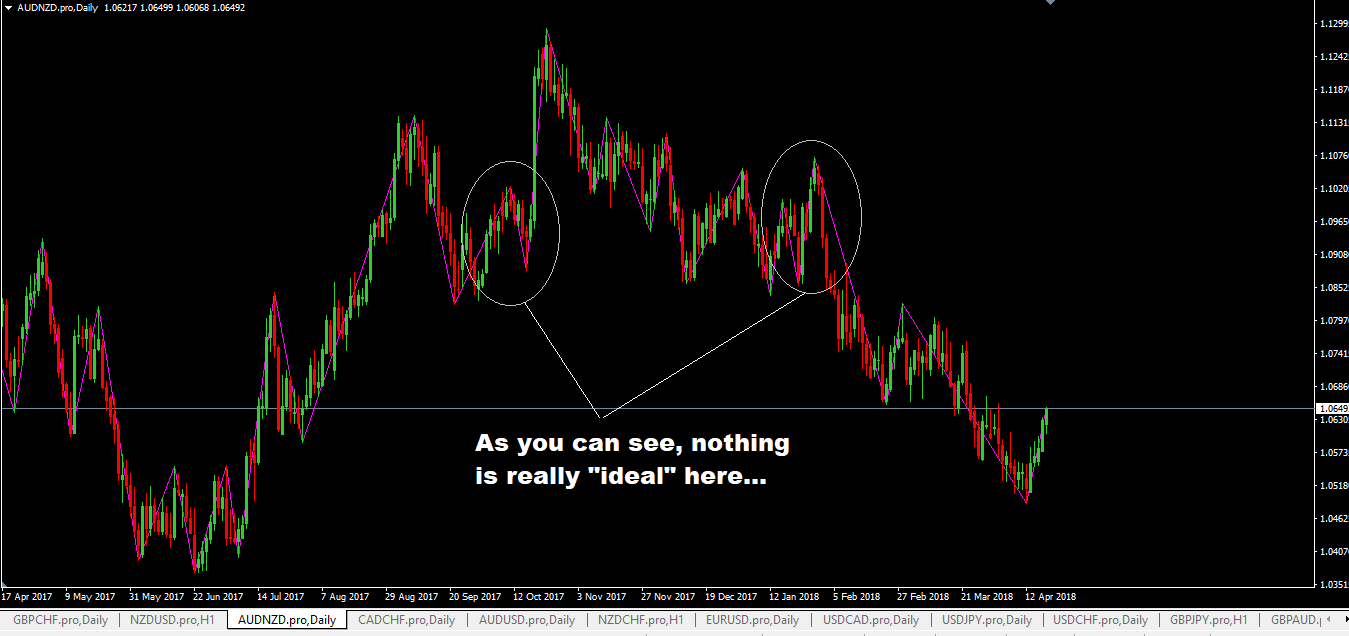

Now, I’ve used the world “ideal” here but reality tends to be a bit confusing so you really have to look behind the “noise” to pick out the price structure.

This is what reality looks like:

Now, the problems is not all swing trading strategies and techniques would allow a swing trader to get in right at these peaks or troughs for price swings:

- some swing trading strategies can can allow you to enter trades exactly on the peaks or bottoms

- some swing trading strategies will have to wait a while to confirm a peak or bottom is formed before a trader enters into a trade

Whatever your choice may be, nobody can tell you what swing trading forex system to use. Its up to you to decide.

What Are The Best Swing Trading Strategies

There a lots of forex swing trading strategies, some for free an some you have to pull out your wallet. Not all traders will use the same type of swing trading system. Everyone is different.

Some swing traders will use pure price action trading whilst others may use a combination of price action as well as indicators like moving averages.

Whatever the case may be, I think the best swing trading strategies are those have the potential to allow you to buy at the very bottom or sell at the very top of price swings.

Let me explain a bit differently: the best swing trading strategy must be able to buy or sell the the right time when a swing ends. That means buying when a downswing ends in and uptrend and selling when an upswing ends in an uptrend.

In my opinion, to identify key price action turning points, you have to apply price action trading to swing trading.

The use of forex reversal candlestick patterns as well as forex charts patterns, support and resistance levels etc can help in trying to get into buy and sell trades at these ideal locations.

Look at this chart below:

- this market is in an uptrend

- the best location to buy in an uptrend is when the downswing is just about ending and the next upswing is about to start.

- to do that, you need the assistance of price action, especially bullish reversal candlestick patterns, on this chart below, you can see a bullish pin bar. That would have been a perfect buy signal and right after that, price shot up, making another upswing in that uptrend.

Similarly, in a downtrend, the best sell location would be where the upwswing is just about ended and the downswing is just about starting. With the aid of price action and bearish reversal candlestick patterns, you can determine the swing turning points in the market and get prepared to sell.

Price Action Key Turning Points

Price action key turning points are locations on the chart where price may change its direction. These include the following:

- support levels,

- resistance levels

- support turned resistance levels

- resistance turned support levels

- Fibonacci levels

- key pivot levels on charts

- trendline touch/bounces

Once you’ve have identified these levels where price can turn/reverse, the next thing you do is to look for the buy and sell signals. These 12 forex reversal candlestick patterns are really helpful in that.

There are some forex trading strategies on this site that will fall in the category:

- trendline trading strategy

- support and resistance forex trading strategy

- diagonal price channel forex trading strategy

- horizontal price channel forex trading strategy

- floor traders method forex trading strategy

Swing Trading Vs Day Trading

What is the difference between swing trading vs day trading?

Day Trading:

- A day trader is actively looking for trading opportunities during the day. All trading happens during the day and no trades are carried overnight.

- This also means that the day trader is generally looking for smaller profits with each trade made.

- forex intraday scalping also comes under day trading category.

Swing Trading

- Swing traders are looking to take advantage of momentum and they will hold their trading positions for longer periods than a day trader.

- The trades can be held for days and even weeks allowing the price momentum to run its course.

- So ideally, with swing trading, in an uptrend for example, traders will be looking to buy on pullbacks and in a downtrend, traders will be looking to sell in a rally:these are the price structure or price swings that allow the swing trader to get in a better price with a good risk:reward ratio.

- Then benefit of swing trading also is that you are not glued to your computer screen all day long.

- Swing trading will also fit those people that have day jobs. Especially with the Forex market, you can come back in the evening and can trade as a swing trader during the different sessions.

Trading Techniques

Forex traders use a few trading techniques from swing trading, day trading to position trading. What are the pros and the cons of each of these trading techniques?

The following is a very good summary of the different trading techniques which I found in www.forexfactory posted by a trader called Damien in this thread titled : Day Trading vs. Swing Trading vs. Position Trading.

And I”m going to quote Damien here:

Hello fellow dreamers,

The subject for today is the same as the title of this thread!!! Day vs. Swing vs. Position Trading – Which style do you use, and which style SHOULD you be using!

For those not in the know, I will go through a simple explanation of each:

Day Trading:

Also known as ‘Intraday’, positions are usually entered & exited within the same trading day. Obviously scalping fits into this category. Traders in general are interested in quicker, smaller amounts and making multiple trades per day.

Swing Trading:

Swing trading is typically a short to intermediate term trend following system lasting anywhere from 1 to 30 days. Traders who swing trade typically look for trend reversals & retracements for their entry/exit points.

Position Trading:

Position trading, also known as ‘trend trading’, can best be described as a ‘buy and hold’ method. Positions can be open for a few days, a few weeks, a few months or longer. They are also held during periods of minor retracement with the expectation that they will eventually continue trending in the desired direction.

—

With that out of the way, let’s look at some of the pros & cons of each of these types of trading. I know I won’t get them all, so please feel free to add your own ideas of pros/cons, or your own opinions if you disagree. We can update this list as we go…

Intraday Trading

Pros:

– Smaller take profit target = Smaller risk per trade.

– Because of the amount of trades being placed, compounding has a greater effect on your overall profits.

– You can make money faster.

– Makes you ‘Feel Good’. Can be a rush! (Is this really a pro?)

– Allows you to always be actively participating in the market (Is this a pro?)

– Because of the last two, traders can exhibit addictive behaviour (gambling).

– Because most positions are closed out at the end of the day, able to take advantage of interest earned in their account.

– Risk control – positions are closed out overnight so unexpected market changes will not affect your bottom line.

Cons:

– Spread has a larger effect on your overall profits.

– You can lose money faster.

– Very difficult to learn – by some estimates less than 1% of traders become successful.

– Time consuming – very difficult to trade properly if you have a full-time job.

– Fast pace & necessary concentration can make day trading very stressful.

– Extremely Risky! Traders can lose a substantial amount of money in a very short period of time.

– Discipline, proper money management, risk/reward and a profitable system are a lot more important when day trading. Even a small mistake can result in a huge loss.

– Can be harder to predict the market.

Swing Trading

Pros:

– Manageable take profit and stop losses.

– Easier to learn than day trading – higher success rate than day trading.

– Spread has less of an impact into overall profits than day trading.

– Less time involved in actively trading – it is not necessary to ‘babysit’ your trades.

– Can be worked around a regular job – a couple of hours per day should suffice.

– Less stressful than intraday trading.

Cons:

– Can be difficult to learn and become profitable.

– While it requires less time than day-trading, preparation and analyzing the markets is still necessary and can be time consuming. Tending your positions daily is a must!

– Some traders have a tendency to develop emotional attachments to a trade.

– Discipline and keeping emotions in check are very important. It is not uncommon to exit on a retrace or trend change only to have the market immediately change back and head in the original direction.

Position Trading

Pros:

– The most forgiving type of trading – small mistakes are more easily absorbed in market movement and the size of your eventual profit.

– The easiest to learn. It is estimated that up to 25% of position traders learn to become profitable.

– Less stressful than intraday or swing trading.

– Easier to become successful with smaller startup capital.

– Much easier to predict the market as in general you will be following the overall trend.

– In general position trading is the most profitable.

– Less time consuming than day trading.

Cons:

– Compounding has a lot less effect on profit than both intraday and swing trading.

– Because positions can be highly leveraged and trades remain open for extended periods of time, unable to reap consistent benefits of interest.

– There is inherent risk in keeping positions open over night. It is quite possible for drastic changes to occur in the market while you sleep.

– Money can be tied up for an extended period of time. This can prevent entry into new positions as they arise.

– Because of the length of time involved in position trading, traders can experience significant drawdown with the expectation that it will turn around and start trending back in the desired direction. Psychologically this can have a very negative effect.

SUMMARY

While position trading is more profitable, day trading is less risky. The emotional element (discipline and self control) is also of more significance while day trading. The higher the time-frame, the better the chance to succeed and become profitable overall.

What Kind Of Traders Use Swing Trading?

Swing trading is a popular trading style with professional traders, and is used by individuals and commercial traders alike.

Pure day traders often view swing trading as having greater risk, because trades are held overnight, but when traded correctly, swing trading has no greater risk, and can be very profitable.

A swing trading position generally can be held longer than a day which makes it different from trend following and buy and hold investment strategies.

Swing Traders are different from day traders in that they let their trades run for days to weeks. Swing Traders do not look to trade and make money daily like the day traders do.

Swing Trading involves letting trades run for days which gives it the potential to gain much more profits. In essence, this is best described as “letting the market do its job”.

Swing trading is different from the following trading techniques:

- In a buy and hold investment strategy, a trading position can be held for months or years.

- In a day trading strategy, trades are opened and closed within that day of trading.

In Swing Trading, profits can be made by engaging in either Long or Short trading.

Swing Trading And Technical Analysis

If you want to be a swing trader, you should spend time studying technical analysis. Learn about:

- Price Action which involves candlesticks and different types of patterns. This includes bullish and bearish reversal candlestick pattern. Its a must to know these!

- You should be familiar with the use of moving averages like exponential moving averages and simple moving averages, moving average convergence and divergence (MACD), stochastics, RSI, and SAR forex indicators.

- You should also study how trends form and change. Learn about the “Dow Theory”. This knowledge will allow you to be miles ahead of the rest.

- As a swing trader you should also know how to use trendlines in your technical analysis.

- In addition, you should know what support and resistance levels are.

- As a swing trader, you should be familiar with the use of fibonacci tool also.

Should You Involve Fundamentals Into Swing Trading?

It really depends entirely up to you.

But you see, I’ve been on occasions in the beginning when I was started to trade forex, made some perfect swing trades only to have price move drastically in the opposite direction.

Why was the reason?

Well, in the forex market, the biggest price driver is the fundamental factors. Things like interest rates, employment and unemployment figures, CPI all drive the price of a currency up or down based can can set price moves up or down for many weeks and months.

Therefore you should at least have some knowledge or learn about these things to have an idea of how they drive the forex market. And then combine that knowledge with what the price is showing in the market and wait or look for the right time to buy or sell.

The subject of fundamental analysis deserves a course or post of its own and maybe I’ll find the time to write up something but I don’t want to get too detailed here.

Advantages Of Swing Trading

- you look at the big picture and don’t get shaken or moved by those daily fluctuations.

- excellent risk to reward ratio: potential for hundreds of pips profit in each trade whilst risking little.

- over-trading is minimized..

- you do not need to get stuck in front of the computer screen like a day trader.

- trading with the main trend.

- its a good trading technique for people who have day jobs to get involved with.

Risks Of Swing Trading

Every trading technique has its risks. If you are a trader that don’t like risk, don’t get involved with with forex trading or swing trading for that matter.

Expect that trading loses will happen. There’s only one thing which you can control in trading and that is risk.

Once you are in a trade, you are at the mercy of the market. You cannot influence or change the direction of price. Price will go where it want to go based on supply and demand.

Your job as a swing trader is to manage your risk. Otherwise you will lose money.