What are forex timeframes? In this post, you will learn about:

- What are the timeframes in Forex?

- What are the different timeframes?

- How to trade using different timeframes?

For the discussions of timeframes in this post, I will be referring to the MT4 trading platform.

What Are Forex Timeframes?

Forex timeframes by definition are simply the different times which can be used to view how the price has moved, is moving, and also traders can perform technical analysis on the charts.

In an MT4 trading platform, when you open it up, you will see this:

As you can see in the above chart, in the MT4 trading platform you have 9 different timeframes:

- M1 = 1 minute timeframe

- M5 = 5 minute timeframe

- M15 = 15 Minute timeframe

- 30M = 30 minute timeframe

- 1H = 1 Hr timeframe

- 4H = 4hr timeframe

- D1 = Daily timeframe

- W1 = Weekly Timeframe

- M1 = Monthly Timeframe

Why The Different Timeframes?

There are a few reasons why traders use different timeframes:

- For technical analysis, to see the big picture: if you are doing technical analysis on 1 minute timeframe chart and you want to know what the bigger trend is, you really can’t see it on your chart on 1 one minute chart. You have to switch to a daily, weekly, or monthly chart to see the big picture of how the price is moving and where it is likely to go next.

- The forex trading system or the strategy you are using requires a certain timeframe. For example, forex scalpers will most likely be using the 1-minute and 5-minute timeframes for trading. Whereas the swing traders would most likely be using the 4hr or the daily charts for trading.

- for multiple timeframe trading. Check out the multiple timeframe trading course.

How To Trade Using Different Timeframes

Some traders only stick to trading only one timeframe.

Others like to see what is happening in multiple timeframes before deciding to buy or sell in a specific timeframe.

This technique is called multiple timeframe trading.

Each Timeframe Has Its Limitations And Advantages

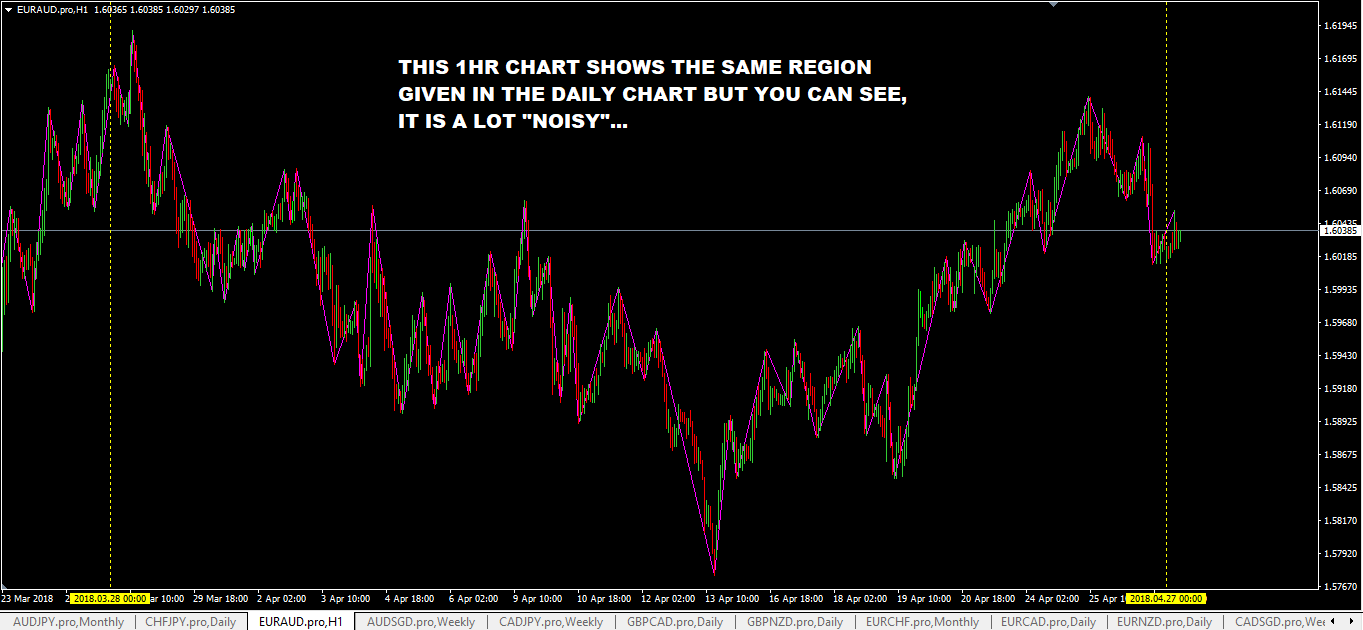

The lower you go down in timeframes, the price behavior becomes “noisy”. The higher timeframes you use, the less this noise becomes but then opportunities to get into an early trade found in the lower timeframes that results in big price moves that may continue for days and weeks will be missed.

As an example, compare these two charts below:

- The first is the daily chart

- The second chart is the 1hr chart showing the same region shown in the daily chart.

Here’s the 1 hr chart:

Best Forex Timeframes To Use When Trading?

I trade using multiple timeframe trading techniques so I look at all the chart timeframes and try to find the best entry point or level in a much smaller timeframe like the 1hr even down to the 1 minute.

The choice of what timeframes to use is up to you depending on your trading personality.

If you have a day job, you cannot trade using smaller timeframes. That would be quite impossible.

What you would need would be a kind of set and forget trading system where you place your orders and walk away and after work, come and check to see how your trade has progressed etc…

If you trade using 5 minute and 1 minute timeframes, you’d be spending a lot of time staring at your computer screen. Otherwise you would miss those valid trading setups that form to get into a trade to make profit.

Trading based on larger timeframes is different than on smaller timeframes because trading setups take a while to form and as they get nearer to the buy or the sell area that you’ve analysed, then you can start to pay a little bit more closer attention as you know the setups can happen soon. A lower tiemframe trader really does not have this luxury to stay away longer from his computer.