The horizontal price channel forex trading strategy is used in a situation where the forex market starts channeling horizontally. In other words, price starts moving sideways.

What Is A Horizontal Price Channel?

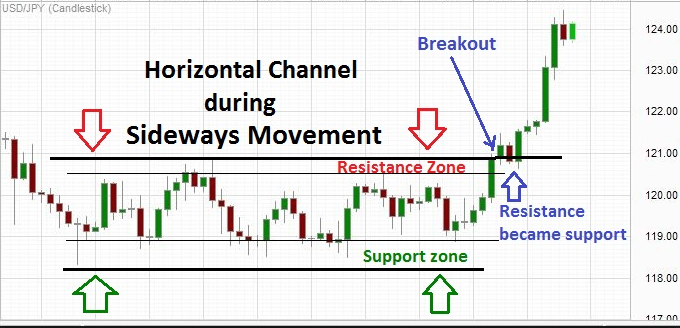

A horizontal price channel happens when market has been trending and then eventually starts moving sideways for a certain period of time.

In a horizontal price channel situation, there are two forces at play: resistance and support. So what you will see is price being restricted to move outside of this channel by the resistance and support zone in this channel.

Eventually, the price will breakout of the horizontal channel.

Here’s a chart giving you and example of a horizontal price channel on the USDJPY:

Trading Parameters

- Currency Pairs To Trade?

You can use the horizontal price channel forex trading strategy to trade any currncy pairs.

- Timeframes Required?

Any timeframe can be used from the 1 minute up to the monthly.

- Any Forex Indicators Required?

No, you don’t need any indicator with this forex trading system.

But what you need is a good knowledge of reversal candlestick patterns to allow you to take buy or sell trades when the signals are given by those reversal candlesticks.

Trading Rules For Buy & Sell

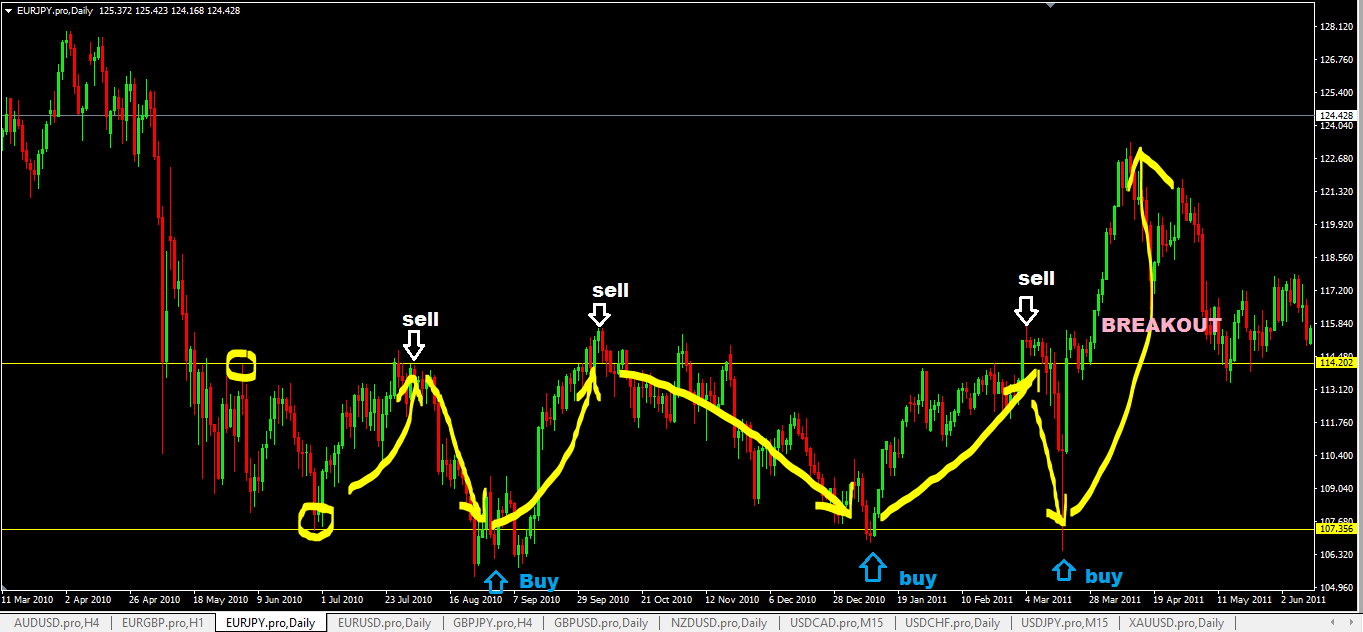

- once you see price starts moving sideways, you need to draw two parallel lines. This forms your horizontal price channel. Sometimes,these two lines can be lines of best fit or at other times, you can use the two swing high and swing low peaks on the out exterminates during the start of the channel.

- then wait for price to hit the two lines

- when price hits top line, look for bearish reversal candlesticks to sell. Place a sell stop order 2-3 pips below the low of that bearish candlestick and a stop loss at least 5-10 pips above the high of the bearish reversal candlestick. Similarly, if the price hits the bottom line, place a buy stop order 2-3 pips above the high of the bullish reversal candlestick pattern that forms and place your stop loss 5-10 pips below the low of the that bullish reversal candlestick pattern.

- for your take profit, aim for the opposite end of the horizontal price channel where the line was drawn:use that as your take profit target level.

Advantages of The Horizontal Price Channel Forex Trading Strategy

- Good risk to reward ratio when a trade turns out as expected.

- An easy forex trading system to trade if you can identify the channel early and take advantage of it.

Disadvantages of The Horizontal Price Channel Forex Trading Strategy

- There’s always the difficulty of exactly knowing if what you seeing on your chart is a price channel formation happening or not.

- then there’s the difficulty of defining the price channel zone to draw your two horizontal lines because many times, price will spike out of the zone and then fall back into the zone.

- As mentioned above, just because you draw a line does not mean price can respond to that line and move down or move up from it, price can just come shy of those lines and go back or it can come past the line, and even knock out your stop loss and then move into the horizontal price channel zone again.

Don’t forget to share, like tweet etc by clicking those sharing buttons below.