The inside bar forex trading strategy is based on the Inside Bar Pattern. For you to understand and implement this trading strategy, you need to understand what an inside bar pattern is.

In here, you will learn :

- what an inside bar pattern is

- how inside bars form and the reason behind that

- the best places on the chart to look for inside bar patterns

- how to trade the inside bar pattern.

What Is An Inside Bar Pattern?

An inside bar pattern is a 2-bar pattern or 2 candlestick pattern that has the second bar completely engulfed within the shadow of the previous bar.

This means that for an inside bar to be relevant, it needs to have a previous bar that has its high and low exceed the high and low of the 2nd bar which is actually the inside bar.

Some people call the first bar the mother bar.

So really, an inside bar is a 2 candlestick pattern and the inside bar itself is the shorter of the two bars where its high and low stay within the shadow of the previous bar.

There are two types of inside bar patterns:

- a bullish inside bar pattern

- and a bearish inside bar patter

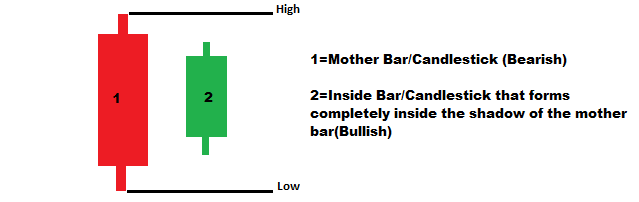

Bullish Inside Bar Pattern

A bullish inside bar pattern is formed when the first bar/candlestick/mother bar is RED or bearish and 2nd candlestick is Green or bullish:

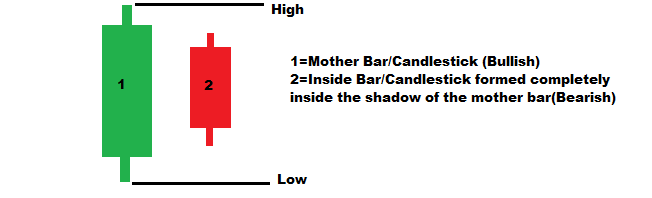

Bearish Inside Bar Pattern

A bearish inside bar pattern is the exact opposite of a bullish inside bar pattern:

What Causes Inside Bars To Form On Charts?

It is important to understand the market psychology behind the formation of inside bars.

When an inside bar forms, what is REALLY happening?

Who is winning?

Bulls or Bears?

Insider bars, when they form, tell you as a forex trader straight away that there is market consolidation happening.

The next question is: what is causing this market consolidation? Well:

- traders are undecided if they want to buy or sell so most so they may stay out of the market.

- it can also be due to low trading activity. Just because forex is a 24hr market does not mean that there’s active trading for straight 24 hrs straight. No, not at all.

- market consolidation can also happen when bulls and bears have equal number of strength so neither one can push the other out of the way much at all.

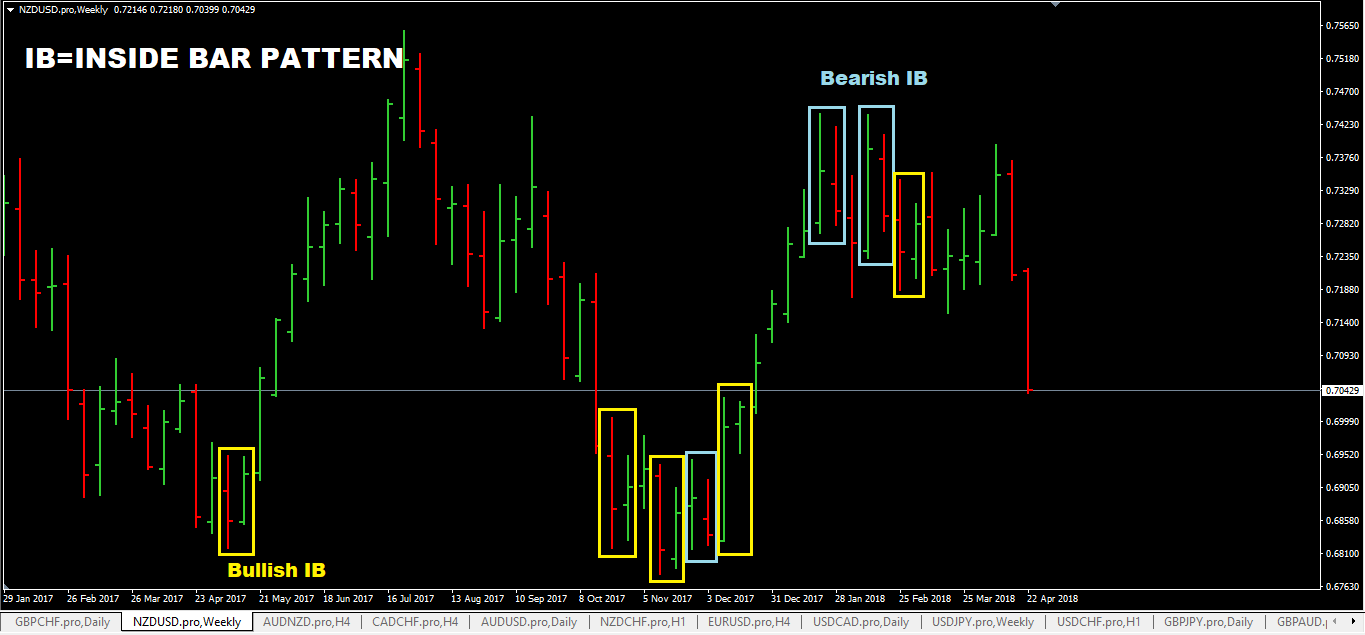

Examples of Inside Bars On Charts

On the weekly chart of NZDUSD below, you can see I’ve shown examples of bullish and bearish inside bar patterns.

Inside Bars Should Be Traded In The Context Of Where They Form On A Chart

Here’s some facts about inside bars:

- they can form anywhere on a chart

- they can also form on important price levels like support and resistance levels, pivots, Fibonacci retracement levels to pivot levels etc.

- they can form on any timeframes, from 1 minute chart up to the monthly.

So Where Is The Best Place To Trade Inside Bars Then?

In my opinion, you should trade insider bars when they form on important levels which I mentioned above:

- support and resistance levels

- Fibonacci retracement levels around 61.8%

- if you like trading with pivots, you can use inside bar trading with that.

Inside Bar Trading Rules (Sell)

- Make sure first that the market is in an obvious downtrend. (Maybe use trend indicator like a moving average or fisher indicator mt4 or something like that). Or price has hit a resistance level and has formed an inside bar right there or soon after.

- as soon as an inside bar forms, place a sell stop order anywhere from 1-2 pips below the low of the inside bar as soon as that inside bar closes.

- Place your stop loss at least 5-10 pips above the high of the inside bar or alternatively, you can place it at least 2-3 pips above the high of the previous bar.

- Take profit when you have a risk reward of 1:3 or look for previous swing lows and if the risk:reward is good, use them as your take profit target levels.

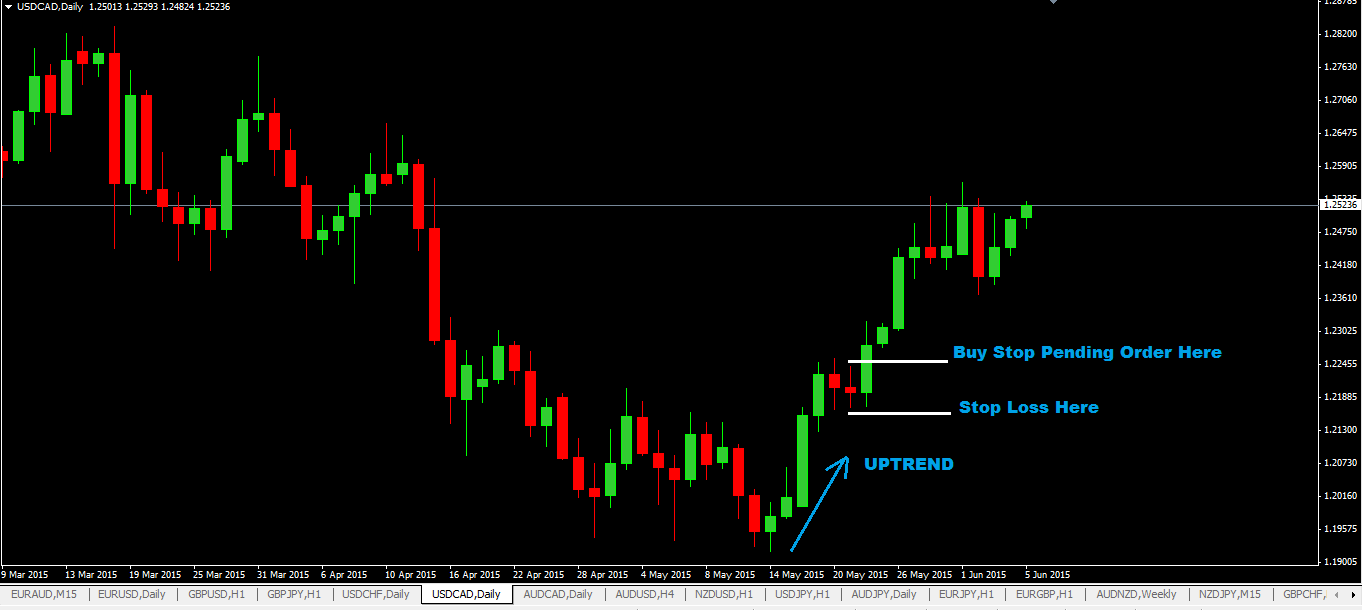

Inside Bar Trading Rules (Buy)

What you do here is do the exact opposite of the sell rules given above:

- make sure the market is in an uptrend. (maybe use trend indicator like a moving average or fisher indicator mt4 or something like that). Or maybe price has hit a support level and a bullish inside bar pattern forms right there or soon after.

- place your pending buy stop order 1-2 pips above the the high,when you see an inside bar form.

- place your stop loss below the low of the inside bar or use the low of the previous bar.

- take profit at 1:3 risk to reward. Or look for previous swing high points and use them as your take profit target level if the risk:reward is also good.

Best Timeframes To Trade The Inside Bar Pattern

In my opinion, the best timeframes to trade the inside bar pattern are the 4 hr and the daily timeframe.

The reason is simple: they tend to reduce the “noise” that is so prevalent in smaller timeframes.

Now, that does not stop you from doing your own testing in the smaller timeframes.

Do your own research based on past data by going through your charts and see how the trading system would have performed.

Inside Bar Expert Advisor

If you are good in coding, you can use the trading rules given above and code your own inside bar forex expert advisor.

I don’t think it would be very difficult thing to do.

Or if you don’t know how to code, then hire an MT4 programmer…just google “mt4 programmer” and there ware lots to choose from in the search results.

Inside Bar Indicator

If you are new to forex trading, finding an inside bar on a chart can be difficult. Well, this inside bar indicator may just be thing thing you need to help you.

When you click this link: inside bar indicator mt4, it will take your to a page where you will download the inside bar indicator.

This inside bar indicator shows inside bars in all timeframes.

Disadvantages of The Inside Bar Forex Trading Strategy

Remember, at the end of the day, the forex market is driven by supply and demand and price is a reflection of this. Just because an inside bar forms on a daily chart does not mean it will be a successful trade if you take that trade.

Far from it, it doesn’t happen that way.

- you will have trades that will turn into losses using the inside bar trading system so expect that.

- try to avoid trading inside bars using lower timeframes from 1hr and downwards. In smaller timeframes, there’s to much “noise” in there for those inside bars to really make any sense at all unless taken in context of the “bigger picture”.

Advantages of The Inside Bar Forex Trading Strategy

- simple forex strategy, easy to understand and implement

- it can be implemented as a set-and-forget kind of forex trading system for those that have busy jobs during the day, like stay at home mums or dads if you can use it to trade using daily inside bars only… and all it would need is less than 5 mins a day to check, place a pending trade and walk away and later check if its activated or not.

- Profits can be huge if you can catch a runner!

Other Trading Resources On This Site That May Interest You

- Free Price Action Forex Trading Signals

- Free Forex Price Action Trading Course

- Free Forex Swing Trading Course

- Free Forex Multiple Timeframe Trading Course

- Huge List Of Free Forex Trading Strategies, from forex scalping strategies, news trading strategies, and more

- Pip Value Calculator MT4 Indicator

- Zigzag Indicator MT4

- Best support and resistance indicator mt4

- Pin Bar Indicator MT4

- Candlestick Pattern Indicator MT4

- mt4 candlestick time indicator (tell you how much time is left in a candlestick before next one forms)

- spread indicator mt4

Don’t forget to share, like, tweet etc. Thanks.