What are tweezer bottom and tweezer top candlestick patterns? What do they look like? What is the psychology behind how the tweezers form? How do you trade them? Where are the best places on your chart to trade them? What type of forex trading strategies can tweezer tops be applied to?

In forex trading, there are many, if not hundreds of different types of candlestick patterns. This article is about one of them: the tweezer bottoms and tweezer tops candlestick patterns.

What is the Tweezer Bottom and Tweezer Top Candlestick Patterns?

The tweezers are reversal candlestick patterns:

- Each pattern consists of two candlesticks of approximately the same length and body.

- A tweezer top pattern is a bearish reversal candlestick pattern and first candlestick is a bullish candlestick followed by a bearish candlestick of approximately the same length and body.

- A tweezer bottom pattern is a bullish reversal candlestick pattern: the first candlestick is bearish followed by a bullish candlestick of approximately the same length and body size.

On the chart below are examples of the Tweezer patterns:

On the chart below, you can see that the price has been in a downtrend and after the formation of the tweezer bottom reversal candlestick pattern, the price moves up.

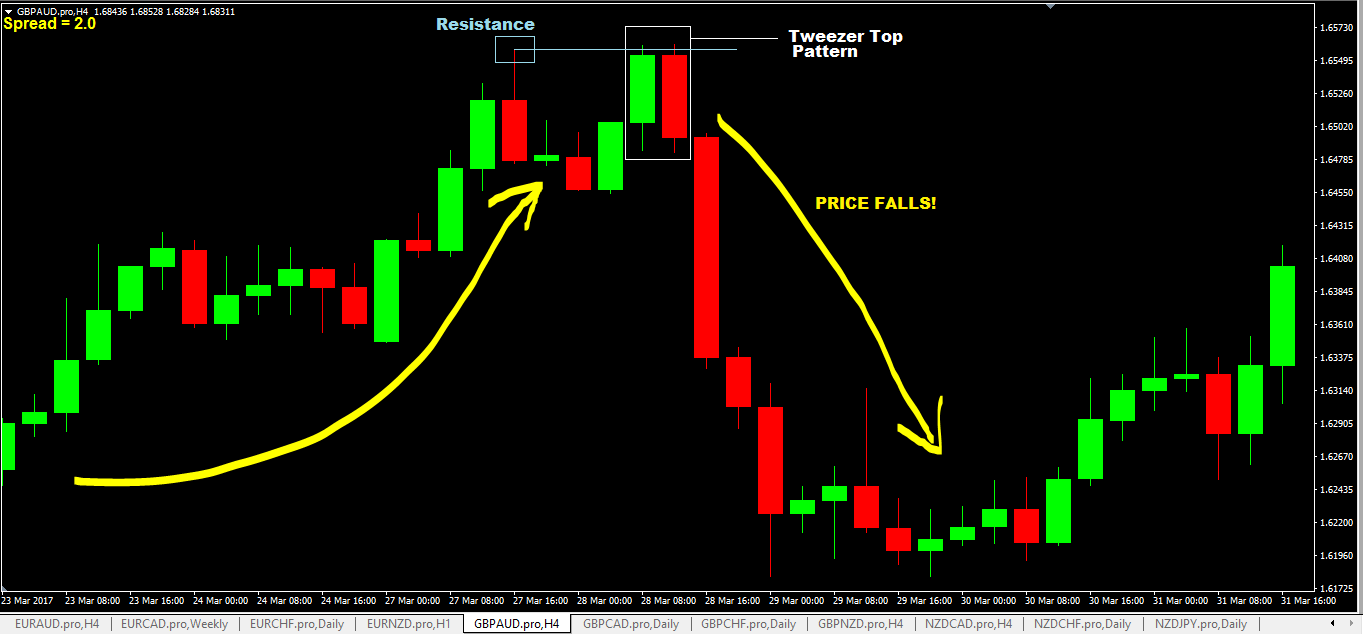

On the chart below, you can see that the price has been going up (uptrend), it met resistance, moved down a bit and then went up to test that resistance and formed the tweezer top pattern in the resistance zone/level/area.

Guess what happens next?

Price falls!

Psychology Behind the Formation of the tweezer bottom and tweezer top candlestick patterns

Understanding the story behind the tweezer pattern is essential. Let’s use the tweezers pictured above starting with the Tweezer top first:

- When the period opened, buyers took immediate control of the market and pushed the price up aggressively, and managed to keep the close of the price at the top.

- On the next period of the candlestick, you can see that sellers were able to come into the market with sufficient supply to hold off higher prices.

- Furthermore, not only were sellers able to bring resistance into the market, but they actually took complete control of the price, and a market reversal occurred.

- Sellers began putting immense pressure on price, and the price fell all the way back down to the first period’s candlestick’s opening price, and closing slightly under it, which is why the length and body of the candlesticks are almost the same.

- This confirms that sellers are now in complete control of the market.

Now, what about the Tweezer Bottom?

Well, it would be exact opposite of above, wouldn’t it?

- Sellers dominate the period in the first candlestick from the opening to the close.

- But the buyers would come in full force after the first candlestick ended and push the price up to the top and keep it there.

Best Place To Trade Tweezer Bottom and Tweezer Top candlestick patterns?

Why is understanding the psychology of the formation of the tweezer important to you as a forex trader?

So that when you see the tweezer top and bottom patterns form on important levels of the charts (support and resistance levels), you will quickly know who the dominant side is and trade according to that side.

Just to reiterate, the important levels you should be watching for the formation of tweezer patterns are support and resistance levels.

These support and resistance levels can be just the regular horizontal support and resistance or they can be resistance and support provided by trendlines etc.

Strategies for Tweezer Bottom and Tweezer Top Candlestick Patterns

There are many forex trading strategies on this site but I’m just going to list a few where you can also look for tweezers as buy or sell signals based on the trading rules of these systems:

- trendline trading strategy

- trendline retest forex trading strategy

- support and resistance forex trading strategy

- diagonal price channel forex trading strategy

- floor traders method forex trading strategy

- support turned resistance forex trading strategy

- resistance turned support forex trading strategy

Another Name for Tweezer Bottom and Tweezer Top Candlestick Patterns?

You may have noticed what the tweezer patterns also look like. Parallel railway tracks.

The other name the tweezer pattern is also known by is, railway track candlestick patterns. You can read more about them here: Top 12 forex reversal candlestick patterns every forex trader needs to know.

Ready to start putting your knowledge to the test. Open a few demo trading accounts at the Top 3 Forex Brokers.