If you know nothing about forex, this free forex trading course will lay down to foundation for you in terms of understanding forex trading and the forex market. It will take your about 10 minutes to get through this forex course if you are fast reader.

What Is Forex?

- Forex is short for Foreign Exchange

- The foreign exchange market, or forex, is one in which a nation’s currency is exchanged or traded for another at an agreed rate.

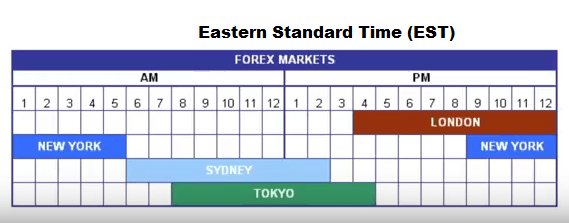

- The forex market is run electronically within a network of banks, 24hours a day, 5 days a week.

- It is the largest financial market in the world with an average daily turnover volume of anywhere between $3-$5 trillion dollars a day. Compare this to the stock market where daily volume is around $500 billion.

The Business Of Forex Trading (And Its Advantages)

- Once you get involved in forex trading, you are essentially running a business.

- the way a business run is to buy something at a lower price and sell it at a higher price so that profits are made.

- there’s is minimal investment required to get involved in the business of forex trading in comparison to starting up a brick and mortar business

- there is minimal time commitment, no office, no employees, no inventory

- recession proof

- You can start trading forex with only $200 accounts

- anyone can succeed in forex trading but to succeed you need to be willing to work hard and master the skill of a professional forex trader You can be lucky in forex trading, but luck will only get you only a short distance in your forex trading venture. You need more than luck…you need to master the skill of professional forex traders that sets them apart from the rest:controlling risk appropriately,proper mindset like grow rich slowly, not get rich quick, long term view vs short term excitement etc.being patient to wait for the right trading opportunities to come your way

- 24hr market gives you flexibility

- you can trade forex from anywhere in the world as long as you have an internet connection

- you can plan your daily trading routine around your day job

- generate consistent profits 5%-20% per month are very possible (for a $100,000 trading account, that’s $5,000 to $20,000 profit a month)

Forex Trading Sessions

There are 3 main forex trading session during a 24hr period:

- New York

- London

- Asia (Includes Sydney and Tokyo)

The table below shows the start and end times for each of the forex trading sessions based on Eastern Standard Time.

Forex Brokers

What are forex brokers? What role do forex brokers play in the foreign exchange market?

Forex brokers are simply companies that provide investors and traders access to the foreign exchange market. They do this by allowing them to open trading accounts with them and having access to their forex trading platform from which they can buy and sell currencies. So after you’ve learned about forex trading, the next step is to find a forex broker and open a live trading with the broker. That’s how you can access the currency market.

Opening forex trading accounts is pretty simple: almost all forex brokers can be found online with a quick google search. Once you’ve found a forex broker’s website, all you need to do is click the “Open a new account” link, and simply follows the instructions there.

You can also open a demo trading account first. A demo trading account is simply trading account which you will use to practice trading with live price feeds but with virtual money and once you think you are ready to trade live then you can open a live/real trading account:

How Do Forex Brokers Make Their Money?

Forex brokers make money in two main ways:

- through spread

- and through a commission or fee per transaction

The spread is the difference between the Ask and Bid prices. So when a forex brokers charges through spread, that part of the cost in involved in your trade. Which means the price need to overcome the spread before your trade becomes profitable.

Those forex brokers that charge a commission per transaction, the fee is deducted from your trading account and not included in your trade. So you don’t need to overcome the spread for your trade to be profitable. But for your trade to be profitable, you need to recover the cost of fee that was charged to your account and then then price has to move some more for you to start making a profit.

Do Proper Research Before Opening A Live Forex Account

Not all forex brokers are the same. Some have really bad reputation so you don’t want to be caught unknowingly opening and account with them and transferring money to your trading account with them.

There are many sources online where you can search for Forex Broker Reviews.

How To Fund Your Forex Trading Account

Once you’ve opened your live forex trading account, you will be given instructions on how to fund your trading account. The following are the main ways you can fund your trading accounts:

- Credit Cards

- Debit Card

- Paypal

- Neteller

- Skrill/MoneyBooker

- Bank Transfer (locally) or Wire Transfer if you have to send money overseas.

Do not use Western Union, and do not send them Bitcoin. If you do, there is no way to dispute the charge in the event that they refuse your withdrawal.

Forex Basics

Forex is quoted in currency pairs. Each currency is given a 3 letter code.

The 8 most common currency symbols are:

- EUR=euro

- USD=US dollar

- GBP=Great Britain Pound

- JPY=Japanese Yen

- CHF=Swiss Franc

- AUD=Australian Dollar

- CAD=Canadian Dollar

- NZD=New Zealand Dollar

The most commonly traded currency pairs are:

- EURUSD

- GBPUSD

- USDJPY

- USDCAD

- AUDUSD

- NZDUSD

- USDCHF

Other Currency Symbols:

- SEK=Swedish Krona

- DKK=dANISH kRONE

- NOK=Norwegian Krone

- SGD=Singapore Dollar

- ZAR=South African Rand

Currency Exchange Rates

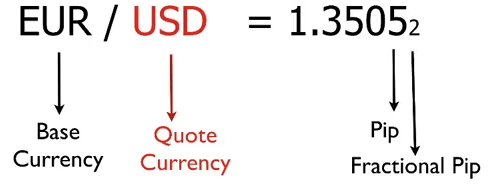

Currencies are quoted in pairs, mostly to 4 decimal places.

The base currency always has the value of 1, in this case above, 1 EUR is equivalent to 1.3505 US dollars at that time period. This means that if you want to buy 1 Euro, you have to pay 1.3505 US dollars. If you were to sell 1 Euro, you will receive 1.3505 US Dollar.

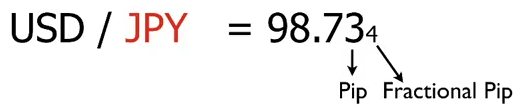

There are other few currencies that are quoted to 2 decimal places, for example USDJPY:

This quote means that 1 USD is equivalent to 98.73 Japanese Yen.

PIP (Price Interest Point)

What is a pip?

- Pip stands for price interest point

- pips is the smallest change in value for any given forex quote

- for all non-JPY forex pairs, 1 pip represents the 4th decimal place of the quote. Example, if EURUSD moves from 1.3000 to 1.3001, it is a movement of 0.0001 or 1 pip.

- For all JPY forex pairs, 1 pips represents the 2nd decimal place. Example, if USDJPY moves from 80.10 to 80.20, it is a movement of 0.10 or 10 pips.

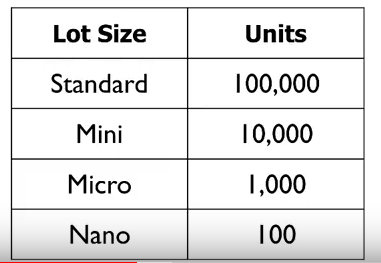

Contract Lot Sizes

The next thing you need to understand is the contract lot sizes.

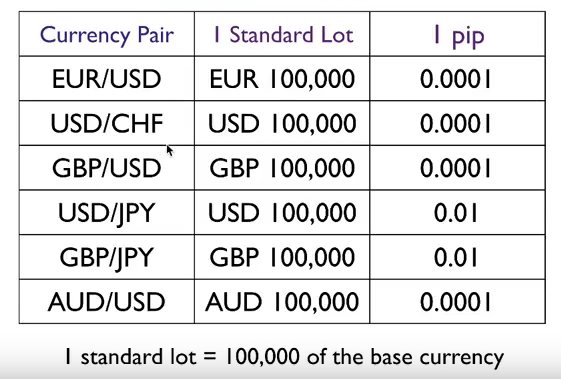

- In the forex market, when you buy or when you sell, you buy and sell in units of currencies called lots.

- So if you buy one standard lot, that means you buy 100,000 of the base currency.

The table below shows how this works:

Other lot sizes: apart from the standard lot of 100,000 units of the base currency, lot sizes can also be traded in mini, micro and nano units as this table below shows:

Calculating Forex Profits And Loss

- In forex, you can make money when the price is going up and you can also make money when the price is going down.

- If you think that price is going to rise, then you initiate a buy trade, or sometimes referred to as “going long”. And if price rises, you make a profit but if it goes the down, you suffer a loss.

- If you think price is going to go down then you initiate a sell trade, sometimes referred to as a “going short.” And if price falls, you make a profit but if it goes up, you suffer a loss.

- The amount of forex profits or loss you make depends entirely on the amount/number of pips you gain or lose on a trade.

Here’s the formula you need to calculate your profit and loss in Forex Trading:

- Profit/Loss=Number of pips x Number of Lots x $Value of Pip Per Standard Lot.

- That $Value of a pip per standard lot is USD$10 or about $10 for most of the actively traded currency pairs.

You can use the pip value calculator mt4 indicator to calculate the $Value per pips of other currency pairs.

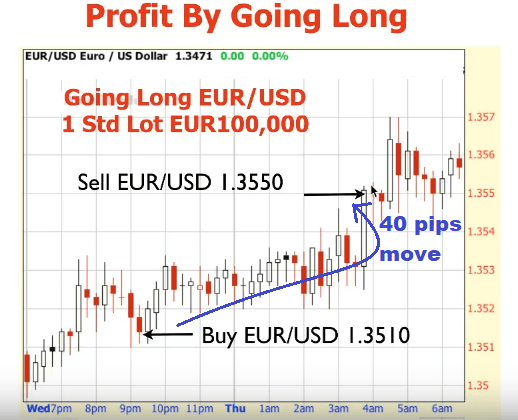

Example of a long trade: Suppose you buy 1 standard lot of EURUSD at a rate of 1.3510 and after some time price rises to 1.3550 and you decided to close your trade.

What is your profit in pips then? It will be 1.3550-1.3510=40 pips profit.

So what is the dollar amount in Profit then? Profit=40 pips x $10 per pip x 1 lot=$400

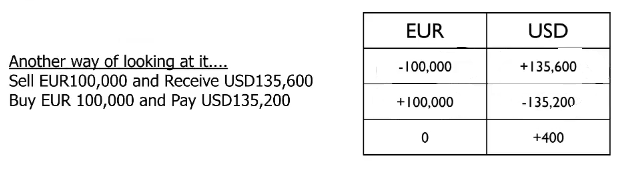

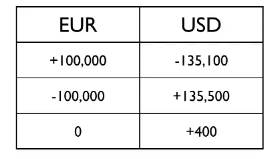

Another way of looking at this would be like this:

- buy EUR100,000 and pay USD135,100

- sell EUR100,000 and receive USD135,500

Without leverage, you would have to invest USD135,000 to earn USD$400. That is a 0.29% return on investment.

But in forex trading, forex brokers allow you to use leverage up to 1:100 times and that can allow you to make good returns on a very small outlay of trading capital on your part.

Here’s an example of making profit by going short (selling) on the EURUSD:

Price moved from 1.350 to 1.3520, a downward move of 40 pips. (3560-3520=40 pips)

Profit=Number of pips x $value per pip per standard lot x number of lots

=40pips x US$10 x 1 lot

=$400

Total profit earned=$400

Leverage And Margin

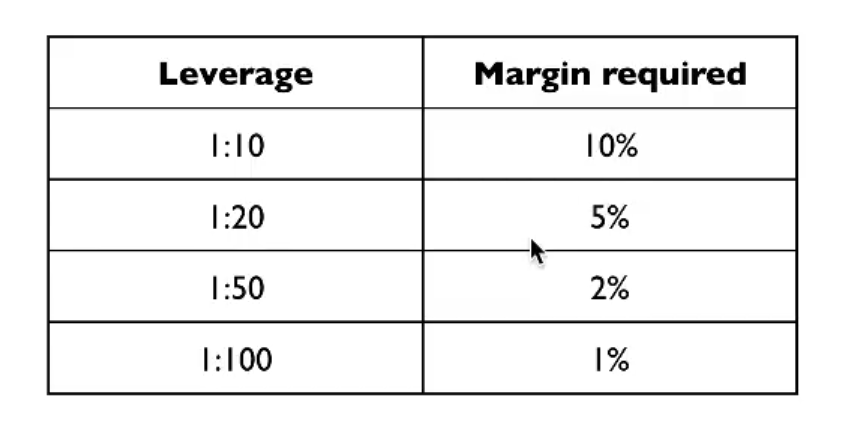

Forex Brokers offer leverage anywhere form 1:10 up to 1:1000.

With a leverage of 1:100, you can buy or sell USD 100,000 with just USD 1,000 margin. That USD 1,000 margin comes from your own pocket…it is money you need to have in your trading account so you can trade 1 standard lot.

Now, I know you are getting confused, right?

What Is Forex Leverage?

Leverage is actually a loan money borrowed from your forex broker so that you can control huge amount of money. Look at it this way: for a leverage of 1:100, you only put down $1,000 and the forex broker gives you $100,000. So for only a small amount of money you put down, you now have access and control to huge amount of money to trade the forex market.

Why? Because without leverage, you need to need to invest a huge amount of money by yourself to make a very tiny return on investment (profit).

Remember this example of a long trade? (Making Profit by going long)

- buy EUR100,000 and pay USD135,100

- sell EUR100,000 and receive USD135,500

Without leverage, you would have to invest USD135,000 to earn USD$400. That is a 0.29% return on investment.

Now, assuming that you are required to deposit only 1 % of the total transaction value in order to trade one standard contract of EURUSD, which is equivalent to EUR100,000, then you will only be required to deposit EUR1,000.

So your leverage (expressed as a ratio of your deposit to that of the forex broker’s loan money) will be Euro1000:Euro 100,000=1:100

What will be your return on investment based on a leveraged trade then based on the trade example above?

Profit you Made = $400

Your Initial Capital = $1,000

($400/$1,000)x100%=40% return on investment.

Now, compare this to the 0.29% return on investment without leverage.

This is what forex leverage does…it increases your return on investment for a very small capital outlay (margin).

But don’t get too excited yet. Leverage is also a double edge sword. Just as you can make a 40% return on investment, you can also lose that much: leverage gives you the chance to increase your return on investment significantly and quickly but can also increase your forex trading loses and you can lose a significant amount of your trading capital.

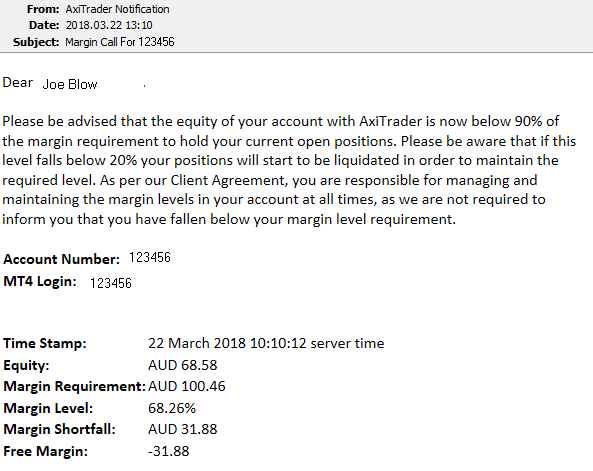

Can you also lose the forex brokers money given to you as a leverage? Hardly! The forex broker has systems in place the constantly monitor you trading positions and as soon as your margin drops to a risk level, the forex broker will do these two things:

- It will first send out a margin call: a margin call will be a notification by email or phone, etc that is sent to you to tell you that you need to deposit more money to keep your margin at the required level to keep your trading position open

- The forex broker will liquidate all your trading positions once your margin drops too low. Remember, the gave you a lot of money as your leverage…they can’t afford to lose even $1!

All these is now done automatically with computers that will send email notification as well as closing down all your trading positions immediately as risk protection.

Here’s is an example of a margin call from Axitrader forex broker for one of my trading accounts:

So What Is Forex Margin Then?

Before you can place a trade, you need to deposit money into your forex trading account. Most forex trading accounts these days are margin accounts. The amount that you deposit will depend on the leverage you agreed on with the broker.

You see, when you apply to open a forex trading account, the forex broker has a handful of leverage options you can select from 1:50 up to 1:400.

If you want an account to trade in standard lots (100,000 units of base currency), the margin percentage that you will be required to deposit is often around 1% or 2%. So if you want to trade a $100,000 position, the margin will be $1,000 (1%) that you have do deposit into your forex trading account. The forex broker will give you the other 99%, which is $99,000.

So what is the purpose of the margin then?

Well, the forex broker uses it as a security. If you trading starts losing and your trading loses start go get close to the $1,000 mark, the broker will:

- initiate a margin call telling you to deposit more money to maintain your proper margin level

- or it will close (liquidate) all your trades to limit the brokers risk as well as yours.

4 Kinds Of Forex Traders

One you get started in forex trading, you need to find out what kind of trader you are. Here are the 4 types of forex traders:

Scalpers

- Very short term traders: trades can last for a few seconds to minutes

- profit target around 5-10 pips

- chart used will be 1 minute and 5 minute charts

Day Traders

- trade during the day: no positions are held overnight

- Profit targets anywhere from 20-40 pips

- Charts used: 15 mins, 1hr and 4 hr charts.

Swing Traders

- Trade duration can last for a few days to a few weeks

- Profit target from 50 pips to 150 pips

- Charts used: 1 hour, 4hrs, and daily

Position Traders

- These traders have a long term view and trades can last many weeks and months

- Profit targets from 500-1000 pips

- Charts used are daily and weekly charts

Forex Brokers

You cannot trade forex without forex brokers. Forex brokers provide the link to the forex exchange market where you can buy and sell currencies for profit.

So once you’ve learned what you need to know about forex, the next thing you do is open a live trading account with a forex broker.

The process of opening a live forex trading account is really simple:

- Do your proper research and find a reputable forex broker like Pepperstone.

- Go to their website and check for link for opening a new account

- Fill in the account opening application form and you will be asked to provide supporting documents like passport/drivers license, electricity/gas bill to verify you live in that particular address

- A few hours or days later, you will receive notification that your account application has been approved and you will be provided with your trading account number as well as the login details.

- You will also be provided with the information on how to make a deposit into you trading account. These days, there are a lot of options to fund your trading account from paypal, credit cards, bank transfer, bitcoin etc.

Forex Trading Platform

A forex trading platform is a software that you are required to use to do your analysis and buy and sell on the forex market. Once you open a forex trading account with a forex broker, they will also provide you with a forex trading platform, usually free of charge. Avoid paying for a forex trading platform.

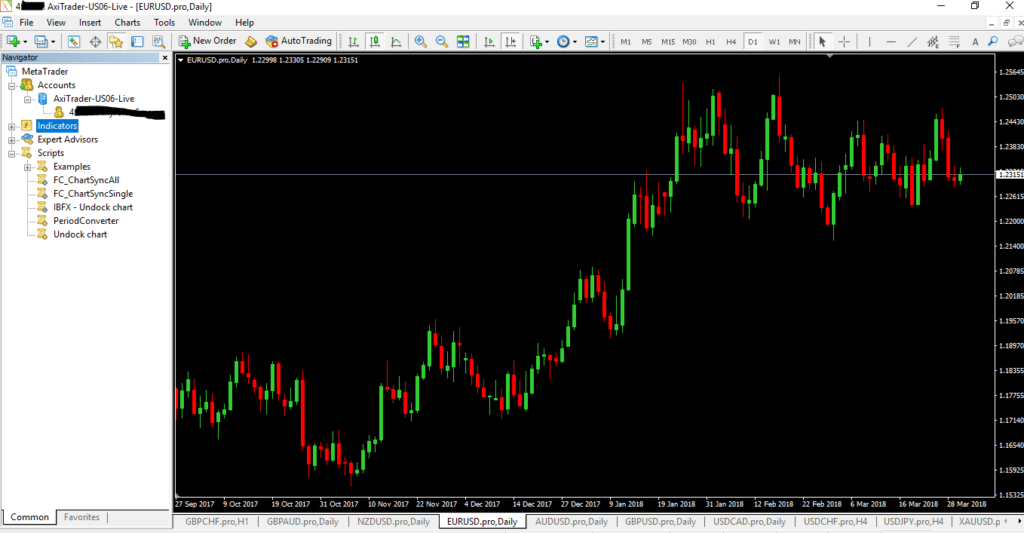

The most popular trading platform with many forex brokers is Metatrader 4 (MT4). It is free. So how can you get MT4 trading platform? Well, during your account application process, you will be asked to select what type of forex trading platform to use. That’s where you select it. So when the forex broker approves your account application, you will also be sent all the information and details on how to download and install the forex trading platform on your computer as well as the login details.

What you see below is what MT4 trading platform looks like when I open it up on my computer.

How To Use The Metatrader 4 Trading Platform

Metatrader 4 is so easy to use.

- To find out what the function of each of the things in the mt4 trading platform does, all you need to do is place your cursor over it and it will tell you what it does.

- To place a new order, you can go to “tools” and select “new order” or your can right-click on an opened chart of a currency pair that you want to take the trade on and a window will pop up and you can create a new order there as well.

- There are 9 different timeframe charts on the mt4 chart written as M1, M5, M15, M30, H1, H4, D,W and M. M1 stand for 1 minute so you can figure out the rest easily. H1 stands for 1 hour. D stands for Daily Timeframe, W stands for Weekly timeframe chart and M stand for the monthly timeframe chart.

Forex Trading Strategies

To trade in the forex market, you need to have forex trading strategies.

Forex trading strategies are simply rules of when to buy and sell when specific conditions are met.

Forex trading strategies can be based on:

- price action, which involves candlesticks and chart patterns

- or a combination of price action and indicators

There are many forex trading strategies on on this site. Check them out.

Forex Trading Risks

Nobody expects to trade the forex market and not make money. Everyone goes into it with very high hopes of even making millions. I’ve traded forex for a while now and I’ve blown so many forex trading accounts already. I don’t want to tell you how much money I’ve lost trading the forex market…it is quite embarrassing. Its not that I’ve lost money all the time and never had success. Heck, I’ve had some good runs in forex, made money and then greed to the better of me and I lost it all.

And I’m telling you now, forex trading is like gambling…call it legalized gambling if you may. And you will lose money, Believe me! And you will learn from it…or maybe you won’t. Me, I haven’t learnt, I’m still a stupid forex trader to an extent.

Ok, now you know there are risks in forex trading: the biggest risk is that you will most likely lose all your money you put into your trading account. So how do you manage your forex trading risks then?

Percentage Risk Management System

In this system you allocate allocate a certain percentage of your trading capital to each trade you place.

Say you have a $10,000 forex trading account and each time you trade, you allocate 1% of whatever your account balance is at the time. In this case, if you open a trade now, you will risk $100.

Now, let’s assume that that trade becomes a loser. So now your account balance becomes $9,900. So next time your open a trade, you will be risking $99, which is 1% of your recent account balance($9,900). If your trading account balance falls to $7,000, you’d risk $70. Or if your trading account balance goes up to $20,000, your’d risk $200 per trade.

The risk % is always the percentage of whatever account balance you have at the time when you open a trade.

Fixed Amount Per Trade Risk Management System

This is the risk management system I use.

In this risk management system, you are risking a fixed amount of $ per trade. I tend to adjust my fixed risk accordingly based on the account size if its increasing or decreasing as I will explain to your below:

- What I tend to do is when my forex trading account increases by a certain level then I increase my $ risk per trade.

- when it falls to certain level then I decrease my $ risk per trade.

Here’s an example:

- Let say you have a $10,000 forex trading account and you risk $100 every trade.

- if you lost $100 on the first trade, then now your account is $9,900. Second trade, you are still going to risk $100, regardless of the account size.

- now you are having a bad losing streak and your trading account falls down to $5000 and you say to yourself ” If I keep risking $100 per trade, the faster I will go to zero balance, if I continue losing.”So instead of risking $100 per trade, now you decide to risk $50 per trade until you bring your account back up to $10,000 and then your can risk $100 per trade again.

On the other hand, lets say that you have increased your trading account from $10,000 to $15,000, a profit of $5000.

So you decide that you are going to risk $150 per trade. Should your account fall back down to $10,000, you will switch back to $100 per trade risk.

Trading Resources On This Site

The following are links to some resource pages on this site for further reading to enhance your forex trading education:

- Forex Price Action Trading Course

- Forex Swing Trading Course

- Forex Multiple Timeframe Trading Course

- Forex Reversal Candlestick Patterns

- How Much Money Do You Need To Start Trading Forex With

- How to choose a forex broker in 8 simple steps

- How To Draw Trendlines The Right Way And Trade With Trendlines